Individual and Family

Health Insurance Alternatives

Published on July 09, 2024

Share

Not every insurance product is right for every individual. For many, health insurance alternatives offer a better value for their money and a better fit for their lifestyle.

Short Term Health Insurance

eHealth offers short-term health insurance, as an option for when you have a gap in your healthcare coverage, offering limited coverage for a short period of time.

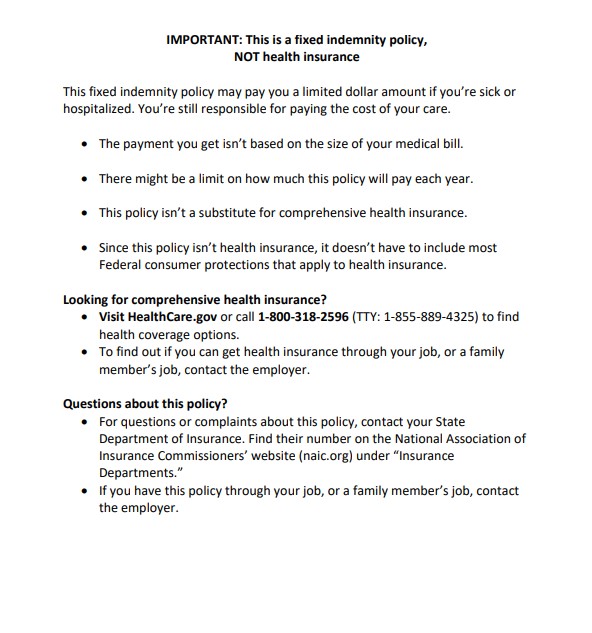

Understand that short-term health insurance will not give you the same amount of coverage as an ACA plan that has the ten essential benefits. In addition, short-term plans can exclude pre-existing conditions. This temporary, limited policy offers fewer benefits and federal protections compared to more comprehensive health insurance options available on HealthCare.gov. It may exclude coverage for preexisting conditions such as diabetes, cancer, stroke, arthritis, heart disease, and mental health and substance use disorders. Additionally, the policy might not cover essential health services including prescription drugs, preventive screenings, maternity care, emergency services, hospitalization, pediatric care, and physical therapy. There is often no cap on what you pay out-of-pocket for care, and you won’t qualify for federal financial assistance to help with premiums and out-of-pocket costs. Furthermore, this type of insurance does not need to meet federal standards for comprehensive health coverage.

Medical insurance packages

Medical insurance packages are viable health insurance alternatives for people who either cannot afford Obamacare or who need to buy insurance outside of the open enrollment period. These plans are not considered qualified health insurance under the ACA. You cannot get ACA insurance subsidies with one of these plans.

However, these health insurance alternatives can offer some protection if you are unable to buy an ACA plan. They typically offer lower levels of insurance at lower costs than ACA plans. Many of these health insurance products are short-term plans that can bridge the gap if you are waiting for the open enrollment period, or are between jobs with employer-sponsored health insurance.

Catastrophic coverage

Before the ACA’s minimum required coverage requirements, many sought catastrophic policies as affordable health insurance alternatives. A catastrophic plan is significantly less expensive than full health coverage. The trade off is that this plan will only cover you in covered catastrophic events. Basic preventative medicine is covered out of pocket. The plan only kicks in if you have major medical expenses, such as those associated with major surgery.

These ACA alternatives might be best for people who are in good health, and wish only to cover themselves in the case of a series emergency. Using this type of limited coverage, individuals will essentially self-insure for small expenses such as prescriptions and check-ups. If the individual suffers a serious accident or illness, catastrophic coverage can prevent them from paying entirely out-of-pocket for catastrophic medical costs.

Ancillary policies

Do you feel that you need specific types of coverage such as dental or vision more than you need wide ranging insurance coverage? If you are young and in good health, purchasing ancillary policies à la carte may present more affordable ACA alternatives for your situation. These health insurance alternatives are designed to cover specific services.

You can choose just one policy, such as just dental or choose several as ACA alternatives that cover the services you will need. Often, the cost will be far lower than the cost of an ACA policy. With these health insurance alternatives, however, it is important to understand that you will have to pay out of pocket for procedures that are not part of your plan.

How can you buy health insurance alternatives?

| Short-term insurance | Gap insurance | Medical indemnity | Dental insurance | Vision insurance | Telemedicine | Rx drug discount program | |

| Coverage for regular doctor visits when you’re unexpectedly sick? | Typically | No | In some cases | No | No | Typically, consultation by phone | Not applicable |

| Can you be declined coverage at all based on your medical history? | Yes | Yes, in some cases | Yes, in some cases | No, but some conditions may not e covered | No, but some conditions may not e covered | Not applicable | Not applicable |

| Does it provide some coverage for preventative care? | No | No | No | Yes | Yes | Not applicable | Not applicable |

| Will it meet ACA (Obamacare) coverage requirement? | No | No | No | No | No | No | No |

Qualified health plans can only be purchased during the annual open enrollment period. Recently, this has been from November 1st through December 15th in most states. However, many health insurance alternatives are not restricted to enrollment during the open enrollment period. Instead, you are able to enroll in these programs at any time of year.

It is important to note that if you change your mind and no longer want ACA alternatives, however, you’ll have to wait until the next ACA open enrollment to sign up for regular health insurance again.

Thoroughly exploring your health insurance alternatives can empower you to make the best insurance choices for you and your family. You may find that ACA alternatives offer the flexibility and cost savings you want, while still providing the coverage that you need. Visit eHealth.com to see what kind of flexible coverage you can get at prices that don’t break the bank.