Affordable Care Act

3 Steps to Understanding Obamacare – And The Alternatives

Updated on March 15, 2024

Share

Updated 9/30/2019

eHealth’s New 2019 Obamacare eBook for Open Enrollment is available for download here: 3 Steps to Understanding Obamacare (and alternatives) 2019.

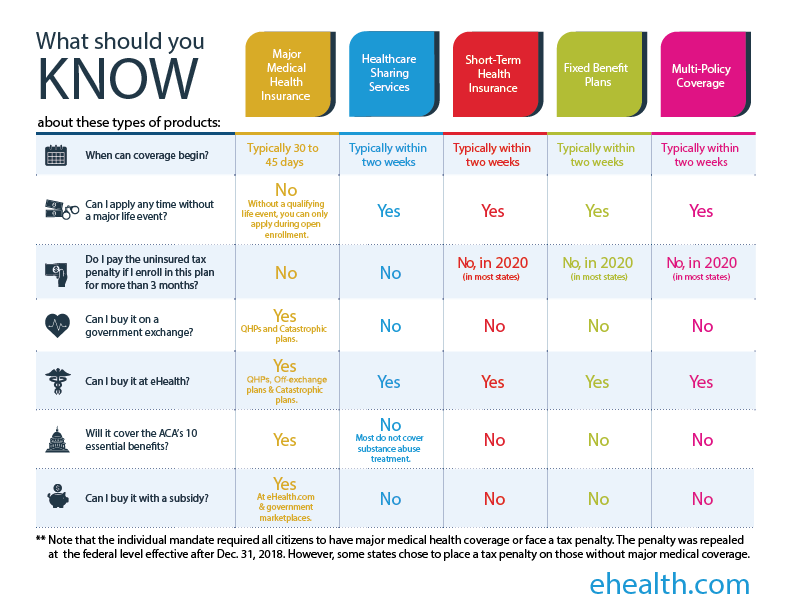

There are a few different kinds of health insurance that you can purchase in 2020 to keep you – and your wallet – covered.

You can purchase major medical plans, healthcare sharing services, short-term health insurance, fixed benefits plans, or multi-policy plans.

In addition to the previously mentioned health insurance products, you can purchase other policies to provide alternative and supplemental coverage. Most of these products you can purchase through online insurance brokers – such as eHealth – as well as offline or directly from health insurance companies or sponsoring organizations.

Major Medical Health Insurance Plans

One type of comprehensive health insurance you can purchase is a major medical health plan. These plans cover the 10 essential health insurance benefits established by the Affordable Care Act (ACA). These 10 essential benefits are the minimum essential coverage than every major medical health insurance plan must cover.

The minimum essential coverage that health insurance plans must cover includes benefits such as prenatal care, preventative care, and mental health and addiction treatment.

While all plans must cover these 10 essential benefits, keep in mind that insurers decide how they cover each benefit.

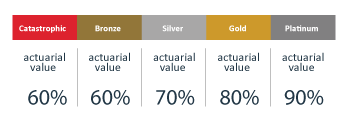

Additionally, ACA maintains its traditional cost and coverage options via their five trademark metallic benefit levels. The cost and coverage for each metallic option are determined by the percentage of the total average costs for covered benefits that a plan will pay, also referred to as the level’s actuarial value.

The five levels – bronze, silver, gold, platinum, and catastrophic – cover an increasingly larger percentage of the total cost of care. Please note that the above numbers are averages for how healthcare costs are split between health insurance companies and a typical population as published by healthcare.gov, your costs will vary.

Bronze health insurance plans have higher deductibles and lower premiums, which may be appealing to generally healthy individuals who do not expect to require a lot of medical care during the coverage year. On the other end of the spectrum, platinum plans have larger premiums and lower deductibles, which may be a fiscally appealing option for someone who has a chronic illness or expects to receive a lot of care during the coverage year.

According to eHealth, bronze health insurance plans are the most popular among eHealth customers (47%) with silver health insurance plans coming in as the second most popular among eHealth customers (33%).

Just because a plan has a low premium doesn’t mean that you will save money. While low-premium plans may seem appealing at first, you may end up paying more toward your premium than you would pay for your care if you chose a health insurance plan with a higher premium and a lower deductible.

When considering which metallic level health insurance plan to purchase it is wise to look back on the care you – and any dependents of yours – have had in the past, what you may need in the future, and if you are planning on scheduling any expensive medical procedures in the upcoming year.

You can purchase the following plans which are compliant with the ACA:

- Qualified health plans (QHP), which can be purchased with a subsidy for those who qualify through private exchanges, like eHealth, or through your federal or state marketplace.

- Off-exchange health insurance plans, which are offered by insurers that are only available on marketplaces such as eHealth

- Catastrophic health insurance plans, which offer bare-minimum coverage of essential benefits for those who are under 30-years-old and who are in generally good health, or to those regardless of age if they qualify for a hardship exemption. You, however, cannot purchase a catastrophic plan with a subsidy.

According to eHealth.com, the average cost of an individual health insurance plan was $448 per month and $1,154 per month for a family plan in 2019.

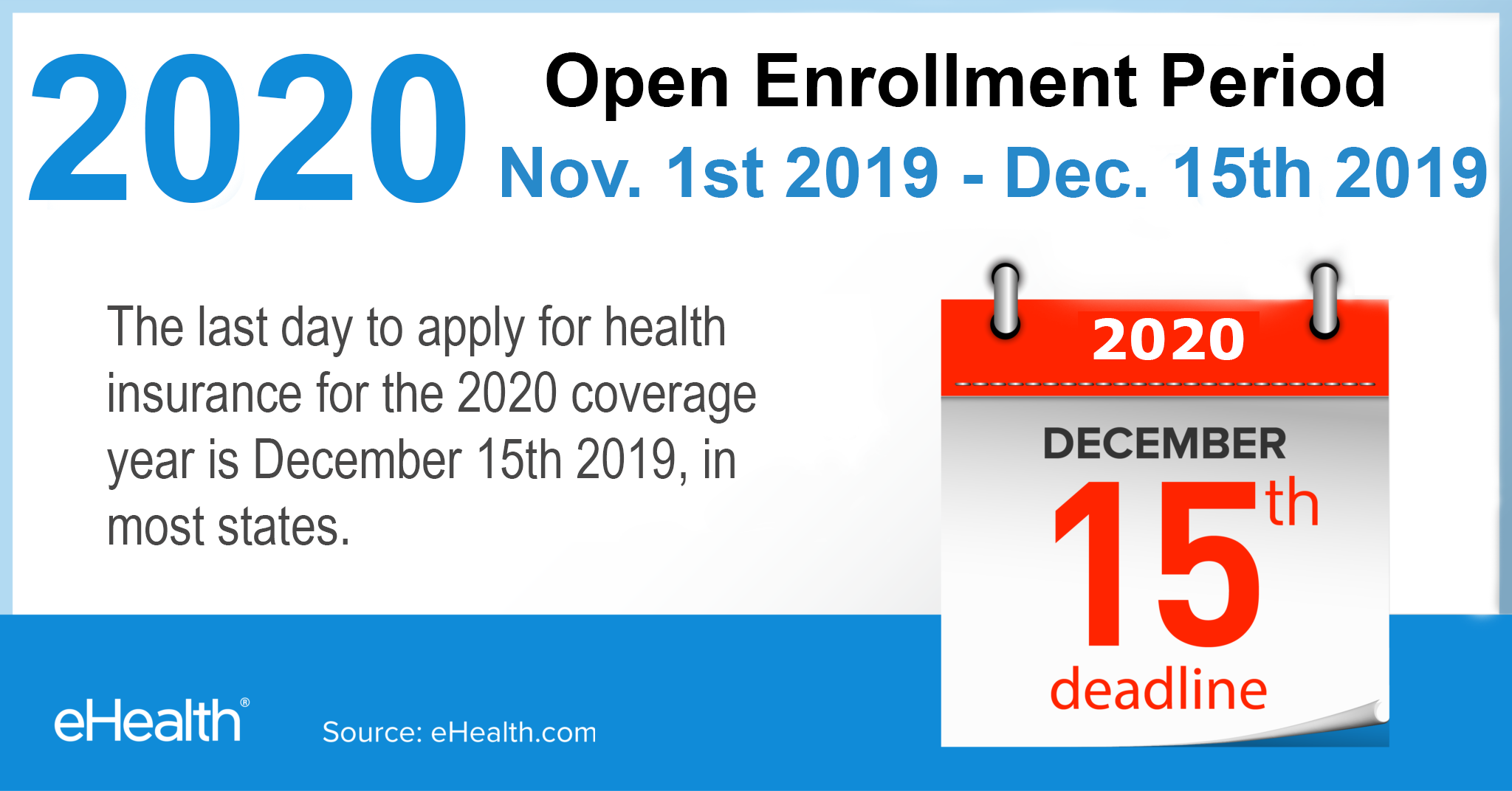

Keep in mind that to enroll in an ACA-compliant plan, you must purchase your plan during open enrollment. In most states, open enrollment runs from November 1st of the year through December 15th for coverage beginning on January 1st of the following year. However, some states have extended .

ACA Frequently Asked Questions

Question: If I’m uninsured and I get pregnant, can I buy coverage so that my labor and delivery will be paid for?

Answer: No, pregnancy is not considered a Qualifying Life Event. However, the birth of your baby is considered a Qualifying Life Event and will trigger a special enrollment period where you can enroll in major medical health insurance.

If you are pregnant and uninsured, you may qualify for Medicaid. Even if you do not think you qualify based off of income, you may qualify because you are pregnant. If you do not qualify, you do typically have options in your area that will help you receive free or discounted prenatal care as well as other medical care. You can read more about your insurance options if you are pregnant here on eHealth.

Question: Can I qualify for a tax credit to buy ACA coverage if I’m married and file my taxes separately?

Answer: No. To qualify for ACA subsidies, you must file a joint tax return. However, if you’ve filed separately in the past, it will not affect you from qualifying for a subsidy going forward. You must report that you’ll be filing jointly for the coming year when you apply.

Question: If I’m on COBRA, can I drop COBRA at any time and pick up an ACA plan?

Answer: No. If you lost coverage and chose to opt into COBRA, you cannot drop COBRA at any time of the year and enroll in an ACA plan. If it is not open enrollment, you cannot enroll in an ACA plan if you choose to drop your COBRA coverage.

However, losing coverage may be a qualifying life event that triggers a special enrollment period that allows you to enroll in health insurance. Instead of opting into COBRA, you may be able to enroll in an ACA plan during a special enrollment period.

Before opting into COBRA, make sure you are happy with your health insurance coverage and can afford your premiums. To learn more about your insurance options and COBRA you can do so on eHealth.

Short-term Health Insurance

Instead of purchasing a major medical plan, you can choose to get short-term health insurance. These plans provide coverage quickly (in as little as 1-14 days), and you can purchase them at any time during the year. Their coverage tends to be less comprehensive than QHPs; however they come at a much lower monthly price.

The benefits that short-term plans cover vary greatly. For instance, you may be able to find a plan that will cover prescription drug costs while others will not. Because of these slim benefits that come with short-term plans, they are much cheaper than ACA-compliant insurance. According to eHealth.com, short-term plans tend to be 80% cheaper per month than an ACA plan.

However, you can be denied coverage if you apply for a short-term plan. Unlike ACA coverage, which cannot consider preexisting conditions, short term plans can deny you coverage based on your health and medical history. You may be rejected if you have a pre-existing condition or you may find that costs related to your preexisting condition are not covered.

Keep in mind that due to controversy about short-term health insurance, some states place strict limits on how many times someone can renew their coverage or how long they can stay on short-term health insurance (these laws are meant to encourage people to only use short-term plans as a temporary solution). On the other hand, some states do not allow short-term plans to be purchased.

States that do not allow short-term plans to be purchased are

- California

- New York

- New Jersey

- Rhode Island

- Massachusetts

If you have more questions, you can use eHealth.com to learn about short-term health insurance in your area.

How major medical and short-term health insurance works

With both major medical and short-term health insurance, in addition to your monthly premium, you must pay a deductible before your health insurance plan starts picking up the bill.

After your insurance plan starts paying for your healthcare services, you will usually only have to pay coinsurances or copays for covered medical expenses. To keep out-of-pocket costs affordable, these types of health insurance plans have out-of-pocket maximums. After you pay a certain amount of out-of-pocket expenses – which include deductibles, coinsurances, and copays – you will not have to pay any more for the coverage year.

The above example is for an individual who has a health insurance plan with a $1,000 deductible, 20% coinsurance, and a $6,000 out-of-pocket maximum. Keep in mind that this example, the medical bill incurred is assumed to for covered medical expenses.

If you were to incur a $50,000 medical bill, you would pay the first $1,000, and then your insurance will start to pick up the bill. However, with a 20% coinsurance, you would pay 20% of what your insurance would pay for covered medical expenses up to $6,000, which is your out-of-pocket maximum. After you pay your out-of-pocket maximum, your insurance will pay for the rest of your covered medical expenses for the duration of the coverage year.

It is important to keep in mind that if you have a family plan, you may have to reach two deductibles: an individual deductible and a family deductible. This is not true for all plans though, so make sure to check your plan details before purchasing coverage and make sure you understand how these two deductibles work.

In general, once you reach an individual deductible, your health insurance plan will kick in and pay for the rest of the covered care that individual receives for the rest of the coverage year, apart from copays and coinsurance. You will still have to pay out-of-pocket for care for the other individual members of your family until you meet their individual deductible or your family deductible.

Once you reach your family deductible, your insurance will take over the payment for all covered care for the rest of the members of your family throughout the coverage year apart from copays and coinsurance.

Fixed Benefit Plans

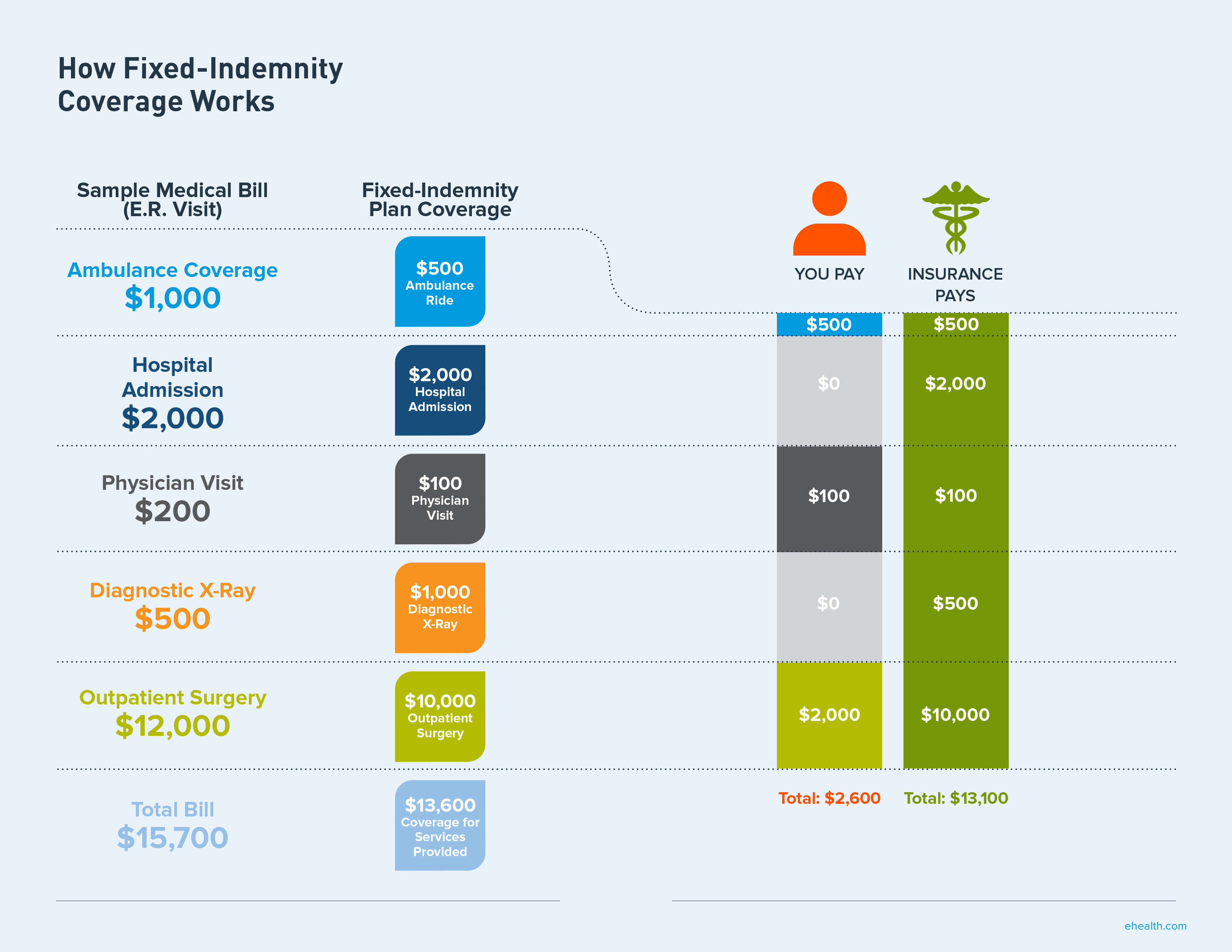

You can also choose to purchase a fixed benefit plan, also called a fixed indemnity insurance plan or a GAP plan. These plans are a type of supplemental health insurance plan that pays you a fixed cash benefit in case you need specific covered health care services.

Fixed-indemnity insurance is a helpful add-on to a regular health insurance plan as it can help you cover out-of-pocket costs for medical expenses that you expect to incur throughout the coverage year. Keep in mind that fixed-indemnity insurance is not a regular health insurance plan and does not have the minimum essential coverage mandated by the ACA.

Unlike major medical plans and short-term plans that start to pay for services after a deductible is met, fixed benefit plans pay a predetermined amount for each service that is provided.

GAP plans also referred to as “deductible protection” plans, are typically used with major medical or short-term insurance plans to help with out-of-pocket expenses. If you have a major medical plan, or a short-term plan, with a large deductible, a fixed benefit plan may be an appealing add-on.

If you find yourself uninsured during the year, and you do not qualify for a special enrollment period, supplement health insurance products like fixed indemnity plans may be a good option to protect yourself until open enrollment.

Keep in mind that like short-term medical insurance, fixed benefit plans typically do not cover healthcare services you receive for any pre-existing conditions you might have.

How fixed benefit coverage works

Fixed benefit – also known as fixed-indemnity – coverage pays out pre-determined amounts of money for covered benefits.

The above image is an example of what a fixed-indemnity plan may payout for an E.R. visit. Your plan would pay set amounts of money for covered services, which leaves you with the rest. In the case of this example, the amount you would pay out-of-pocket is less than 20% of the total bill.

The above example is how a GAP or a “deductible protection” plan would work with both a short term health insurance plan.

In this example, you have incurred a $50,000 medical bill, and you have a short-term health insurance plan with a $2,500 deductible, a 20% coinsurance, and a $5,000 out-of-pocket maximum.

Without the GAP plan, you would have to pay $5,000 toward your deductible and in coinsurance up to your out-of-pocket maximum. However, in this example, with your GAP protection of $5,000, you would not have to pay anything out-of-pocket.

GAP insurance works similarly if you have a major medical plan by helping you cover your out-of-pocket costs. Gap insurance may be appealing not only to those with short-term health insurance but to those who have large-deductible major medical plans.

Multi-Policy Coverage

These types of plans are being offered by a growing number of insurers and licensed brokers. These plans typically include a package of insured and non-insured benefits.

These combinations usually provide complete coverage than a non-major medical plan. With multi-policy coverage, you can usually expect combinations to include short-term for medical, GAP for deductible protection and association memberships for prescription discounts and mobile office visits.

Multi-policy coverage is a great choice for those who find themselves uninsured in the middle of the year and have not experienced a qualifying life event. These plans will not cover the ACA’s minimum essential coverage benefits but will provide you with more comprehensive coverage than other non-major medical plan options.

Healthcare Sharing Services

You can also decide to join a healthcare sharing service. Healthcare sharing services are commonly known as cost-sharing ministries or faith-based cost-sharing services.

Healthcare sharing services are typically groups of like-minded people that agree to help one another with their medical bills. Most of these healthcare sharing groups are organized around a common ethical or religious belief.

These plans typically are cheaper than major medical plans. However, unlike major medical plans, you can be declined coverage if you do not subscribe to the group’s belief system.

Additionally, these services may not cover the basic essential coverage mandated by the ACA. For instance, these organizations may not cover substance abuse treatment. However, if you in a healthcare sharing service, you will not have to pay the uninsured tax if you live in a state that imposes the tax penalty at the state level.

The beliefs and opinions of health sharing ministries do not belong to eHealth.

Association Health Plans – Insurance you can buy across state lines

Limited medical plans and benefits are available for purchase today through associations, and these benefits are sold across state lines.

AHPs are different than typical group health insurance, the type of health insurance you would typically receive through an employer, because you have more flexibility when it comes to complying with ACA standards and regulations with what plans you offer to your employees.

If you are a sole proprietor or have a small business, you may qualify for membership in one of these organizations. Make sure to use caution when choosing to join an Association Health Plan, because these plans are not regulated in the same way that qualified group health insurance plans are.

A note on the uninsured tax

It’s also important to keep in mind that while the individual mandate tax (a fine previously applied to those uninsured for a certain amount of time) has been repealed at the federal level, there are still some states that require their residents to pay a tax if they go uninsured.

Short-term health insurance, fixed benefit plans, and multi-policy coverage will not keep you from being fined in these states.

Those who can afford ACA-compliant health insurance and choose to go without it may be subject to a tax penalty in the following states:

- Massachusetts

- New Jersey

- Vermont

- Washington D.C.

- California (starting in 2020)

You can learn more on eHealth about the specifics about the individual mandate fine in the above states if you have more questions.

ACA provisions allow people to enroll in major medical plans during the open enrollment period, which runs from November 1st through December 15th each year in most states for coverage beginning on January 1st of the following year.

However, some states that allows you to enroll in major medical health insurance. You can read about when the open enrollment period is for your specific state on eHealth.com.

If you experience a life change anytime during the year, called a qualifying life event, you may qualify for a special enrollment period which allows you to enroll in a major medical plan outside of open enrollment.

Special enrollment periods typically last 60 days. During that time, you will be able to get health insurance through your state or federal marketplace, or through online brokers – such as eHealth. Keep in mind that you will have to prove that you have experienced a qualifying life event.

Examples of qualifying life events include:

If you find yourself without coverage, you still have health insurance options outside of open enrollment.

You can apply for government health insurance programs such as Medicaid or CHIP since there is no open enrollment period you can apply throughout the year. Keep in mind that you will need to meet an income requirement to qualify for these programs.

If you do not qualify for government assistance or a special enrollment period, you can enroll in short-term health insurance or purchase other supplemental health insurance policies since you can enroll anytime throughout the year. Short-term plans are a great solution for temporary coverage, or for those who cannot afford more expensive plans with extensive benefits.

If you are uninsured or shopping for a major medical plan to purchase during open enrollment, there are several ways you can buy health insurance.

One option you have is to enroll through government exchanges. Some states have created their own state exchange, while other states choose to use the federal government exchange. These exchanges are typically staffed by specialists who can help you navigate your enrollment. However, these specialists are not required to be licensed insurance agents.

Another option you have is to enroll through licensed private exchanges, such as eHealth. You can buy several different types of insurance on non-government exchanges, some of which are not available on the federal government exchange or your own state exchange.

eHealth’s brokerage services are free. Insurers pay brokers to get applications accurately and on time. eHealth’s agents are not only licensed but provide unlimited support once enrolled.

To make your enrollment process as seamless as possible, it is a good idea to collect the necessary personal information and documents to have on hand while you apply. Read eHealth’s QHP checklist to learn more about what you’ll need to apply for health insurance.

How can you buy with tax credits?

ACA subsidies, also referred to as Premium Tax Credits, work on a sliding scale to limit your monthly premiums to a fixed percentage of your income if you buy the “benchmark plan.”

The “benchmark plan” is the second cheapest silver health insurance plan available to you in your area. If the “benchmark plan” costs more than the fixed percentage of your income, you may qualify for a subsidy in the amount of the difference.

You are likely to qualify for a health insurance subsidy if your total household income is between 100% and 400% of the federal poverty line (FPL). If you earn 133% or less than the FPL, you are likely to qualify for Medicaid in most states. Some states, like California, have expanded their subsidy program so that those making over 400% of the FPL can qualify for some assistance.

Keep in mind that eligibility for the upcoming coverage year is based on the FPL guidelines for the previous year. For example, eligibility for subsidies in the 2020 coverage year is based off 2019 FPL guidelines.

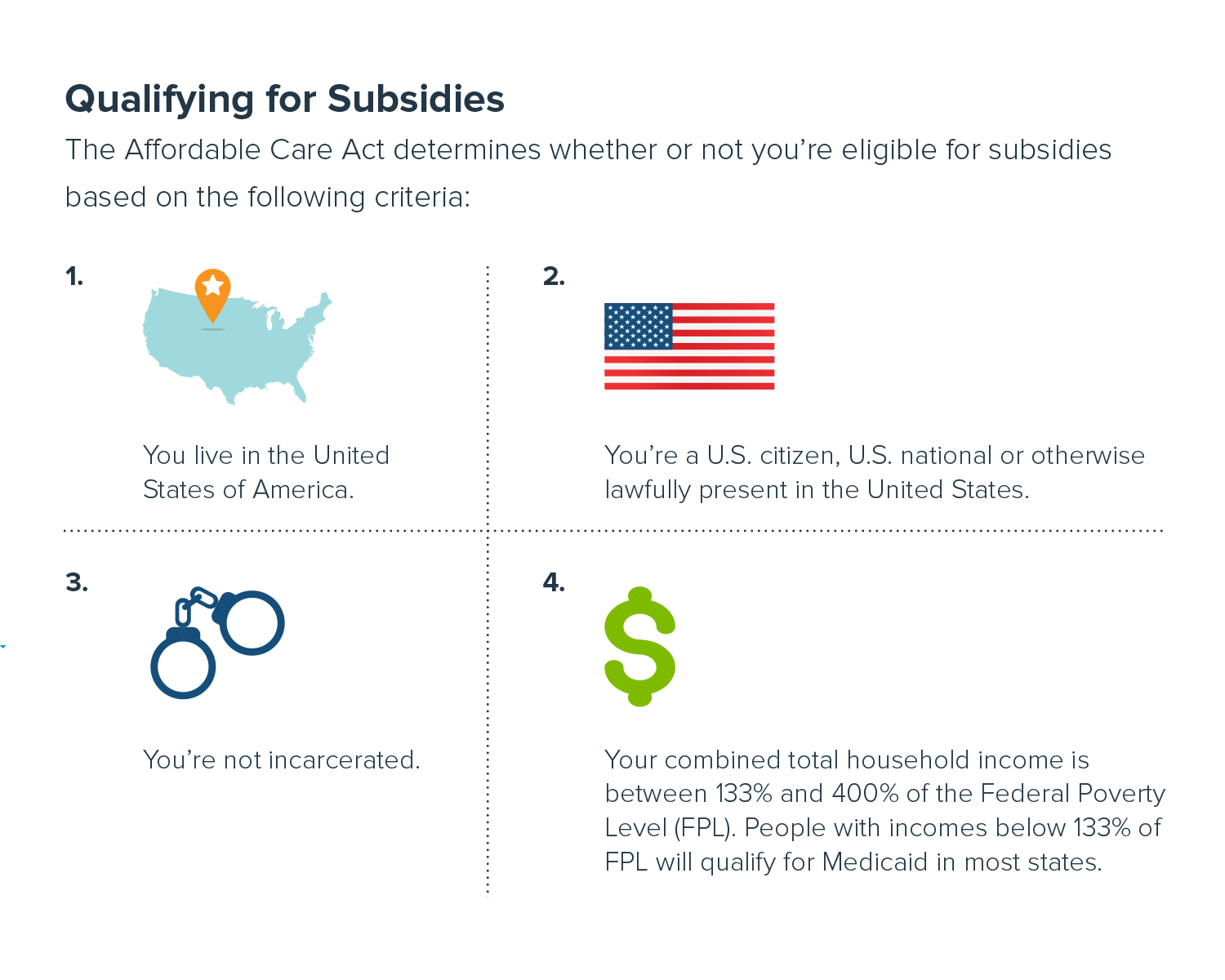

Additionally, you must live in the United States, be a citizen or lawfully be present in the U.S., and must not be incarcerated to receive subsidies.

Keep in mind that even if you make slightly above the FPL cut off for subsidies (401% of the FPL), you will not be eligible for subsidies. Making slightly above this cut off can lead to an individual or a household, losing hundreds of dollars in subsidies. This steep cut off is referred to as the subsidy cliff which greatly affects middle-income families and older individuals living in rural areas.

You can learn more about if the ACA subsidy cliff could affect you by reading more on eHealth.com.

You can determine if you are eligible for a subsidy by submitting your zip code and income information on eHealth.com

Finding the plan that’s right for you

For those who do not enjoy the benefit of group health insurance through an employer, finding the coverage that’s right for you can feel daunting. Health insurance is complex and requires careful thought and assessment before you make a decision.

You must weigh the costs of buying and maintaining health insurance versus the consequences of going without it.

It’s always a good idea to look back on the care you – and your family – have received in the past, when deciding on coverage for your future. Make sure you consider what care you might need, what coverage you may need in the case of an emergency, and what – if any – expensive medical procedures you may plan in the coming year.

eHealth’s unbiased licensed insurance agents are here to help you find coverage that meets your medical needs and fits your budget. Our agents also can guide you through your research and help you enroll in the health insurance plan you choose. Start shopping today with the nation’s first and largest health insurance marketplace for individuals, families, and small business.