Affordable Care Act

Fixed-Indemnity Insurance

Published on July 11, 2024

Share

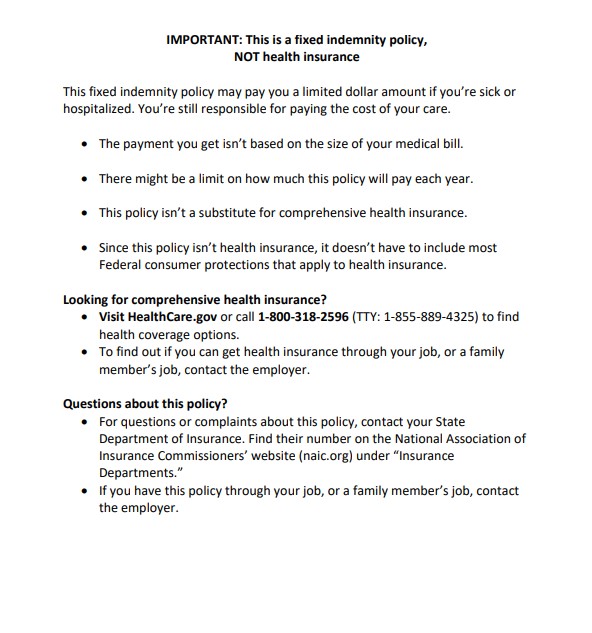

Fixed-indemnity insurance is a type of supplemental health plan that gives you a fixed cash benefit payout in case you experience specific illnesses or injuries covered by your policy. For some consumers, a fixed-indemnity insurance plan is a helpful add-on to a major medical health insurance plan, as it helps cover out-of-pocket costs for medical expenses they expect to incur during the year.

What is fixed-indemnity insurance?

Fixed indemnity insurance is a supplemental health insurance that can help you to manage out-of-pocket costs. These plans can provide an extra layer of protection in the event of serious injury or illness by paying you a set amount of cash benefits for specific covered medical expenses you incur.

Fixed indemnity health insurance is not a major medical insurance plan and, therefore, doesn’t cover the 10 essential health benefits mandated by the Affordable Care Act (ACA).

What does fixed indemnity insurance cover?

There are a variety of fixed indemnity plans on the market, and benefits among plans vary widely. Some of the more common benefits offered by fixed indemnity plans include:

- Daily Hospital Confinement for a set number of days

- Diagnostic Outpatient Care (MRI, Lab Testing, X-rays)

- Intensive Care Unit (ICU) Coverage

- Anesthesia

- Outpatient Radiology or Chemotherapy

- Surgical Procedures

- Emergency Room Visits

- Ambulance

- Some Preventative Care (mammogram, colonoscopy, etc.)

Some fixed indemnity plans may only cover a limited set of illnesses, injuries, drugs, and/or medical procedures, and sometimes do not cover hospital costs at all, so check your policy brochure carefully before you select a plan.

There is no deductible, coinsurance, or copayment applicable to benefits the fixed indemnity plan covers. The reimbursement rate is fixed and typically sent to the insured and not to the provider of service.

A word of caution. Some fixed indemnity plans may look like ACA-compliant major medical plans on the surface and offer an array of covered services. However, unlike ACA-compliance major medical plans, fixed indemnity plans do not cap out-of-pocket costs, since the amount that the insurance will pay is predetermined (based on the terms of the policy) and is based on coverage factors, such as

- The number of days you are hospitalized

- The number of doctor visits you made

- The type of surgery you had.

In determining benefits, the fixed indemnity plan does not consider the total bill. The amount the fixed indemnity plan pays is based on its fee schedule; it is not based on the actual cost of the care that you receive or whether you have other insurance that pays a portion of the bill. This can potentially result in some very high out-of-pocket expenses if you relied on a fixed indemnity plan as your sole or primary source of health coverage.

What does fixed indemnity insurance not cover?

A fixed indemnity plan typically does not provide coverage for pre-existing conditions. A pre-existing condition is an illness, injury, or condition that medical advice, diagnosis, care, or treatment had previously been recommended to or received by an individual within 12 months prior to the effective date of the insurance policy.

Generally fixed indemnity insurance excludes or limits coverage for the following:

- Maternity

- Newborn care

- Infertility treatment

- Prescription drugs

Who is eligible for a fixed indemnity plan?

Eligibility may vary depending on the plan and the state. Usually anyone between the ages of 18 and 64 may apply for fixed indemnity insurance in any state where it is sold.

Keep in mind, however, that fixed-indemnity insurance is not regulated under the Affordable Care Act (ACA). Therefore, fixed indemnity plans are NOT required to

- Provide essential health benefits

- Place a cap on the policy-holder’s annual out-of-pocket spending

- Guarantee issue (that is, a fixed indemnity insurer can use underwriting guidelines in the application process and may deny an application, set limitations, or higher rates for pre-existing health conditions)

When could a fixed indemnity plan be a good choice?

A fixed indemnity plan is not a substitute for the comprehensive coverage provided by an ACA-compliant major medical plan. However, indemnity insurance may be valuable, inexpensive supplemental insurance to a high deductible plan. If you have health insurance, but struggle to meet a high deductible, coinsurance or copayment, a fixed indemnity plan could help you lower some of your out-of-pocket expenses that remain after your other insurance plan pays. And because the indemnity plan benefit is paid directly to you, you have the flexibility to decide how you pay those out-of-pocket medical expenses. A fixed indemnity plan may be worth considering if you are looking for extra protection for certain medical expenses.

If major medical health insurance is not a current option because of your financial circumstances or because you are waiting for the opportunity to enroll in an ACA plan on the marketplace because you aren’t eligible for a special enrollment period, a fixed indemnity plan may be a good option.

Just as you can apply for a fixed indemnity plan anytime of the year, you can cancel a policy anytime you don’t need it. However, remember that it’s always a good idea to enroll in a major medical health insurance plan, and you can do this during the annual Open Enrollment Period (OEP)

If you have questions about fixed indemnity insurance plans or want to compare major medical and indemnity plans available in your area, give us a call or check out individual and family health insurance plans today. At eHealth, you’ll never pay more for health coverage with us than you would elsewhere. Our knowledgeable licensed insurance agents would be happy to walk you through your options and find coverage that fits your needs. Or, if you’d prefer to browse at your own convenience, you can use our user-friendly plan finder tool to start looking at plan options now. Just enter your zip code into the tool to get started.