Affordable Care Act

Fixed Indemnity Insurance – Coverage for the In-Between Expenses

Published on July 10, 2024

Share

If the power went out at your home or a big wind-storm hit, wouldn’t you want an emergency kit with food, water, flashlight, and first-aid supplies ready at hand? Of course you would.

You can think about insurance like the supplies in that emergency kit. Life is unpredictable, so it’s important to be prepared financially in the event you or a family member needs medical attention. A traditional major medical health insurance plan will cover you for many things, but there are other insurance products available to fill in the gaps and help you pay for things like deductibles and coinsurance. One of these is known as “fixed indemnity” coverage.

What does the word indemnity mean?

In insurance lingo, to indemnify something is to “return it to its original state.” In other words, indemnity insurance will help you cover what you may have lost in case of a qualifying event. Like other insurance products, fixed indemnity plans can help give you peace-of-mind by providing an extra layer of financial protection against unexpected medical costs not covered by your regular insurance plan.

Fixed indemnity plans provide an extra layer of coverage

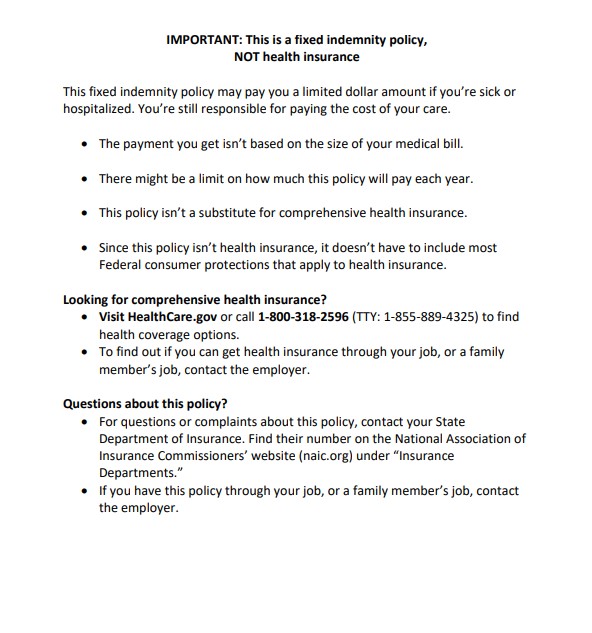

Fixed-indemnity plans are not traditional major medical health insurance plans. The insurance company offering a fixed indemnity plan doesn’t enter into contracts with medical providers, and the coverage provided by an indemnity plan will not meet the requirements under the Affordable Care Act (the law known as “Obamacare”).

If you go more than two consecutive months in a single year without health insurance coverage meeting Obamacare requirements, you could be subject to a penalty on your federal taxes. Fixed indemnity plans do not meet Obamacare requirements because they are not health insurance plans, so they do not provide the minimum essential coverage required by Obamacare, they can exclude pre-existing medical conditions or require waiting periods, and they do not help avoid Obamacare tax penalties. You should think about fixed indemnity plans as an extra layer of coverage on top of your Obamacare-compliant health insurance plan, but not as a substitute.

What does fixed–indemnity insurance cover?

Perhaps you’ve heard of accident insurance plans? Or critical illness insurance plans that cover you in case of a specific diagnosis? Fixed indemnity plans often combine both of these forms of coverage.

With a fixed-indemnity plan you may receive a payout when you have a qualifying accident or injury or when you’re diagnosed with a specific serious illness. When a qualifying event occurs, the money paid out by the insurance company goes directly to you rather than to the doctor. You can use the money to pay for medical bills, or for any other expenses you may face. So, for example, a broken leg may result in a payout of $500 or a diagnosis of cancer may result in a payout of $10,000. Some plans might pay out a certain dollar value per day if you’re hospitalized. Coverage can vary significantly from one plan to the next.

As a “fixed” indemnity plan, the insurance company will only pay out set dollar amounts in certain qualifying circumstances. It’s important to read the details of any fixed indemnity plan you’re considering. But you may use the payout to pay for whatever you like: for example, the annual deductible under your regular health insurance plan, or your rent while you’re out of work.

Summary of fixed-indemnity insurance coverage

As mentioned, coverage can vary significantly from one fixed indemnity plan to another, but as a general rule, fixed indemnity plans share certain common features:

- There’s typically no deductible or coinsurance required

- The provide defined benefits, so you know your payout amounts up front

- Fixed indemnity plans tend to have lower monthly rates than more comprehensive insurance

- They do not provide the sort of coverage provided by major medical health insurance plans

- They do not meet the coverage requirements of the Affordable Care Act (Obamacare), so they will not protect you from the Obamacare tax penalty for not having Obamacare-compliant coverage

- They work best when used as an additional layer of protection, on top of standard major medical health insurance, and not as a substitute

When it comes to deciding on a standard major medical health insurance plan, you want to make the best decision for you and your family. Unfortunately, some people are often not covered for the unexpected things life throws at you – and many don’t have the savings they may need to pay for their deductible in case of a serious medical condition. It is important to have coverage for the most unexpected situations.

If a fixed-benefit indemnity insurance plan sounds right for you, please visit eHealth.com to compare affordable health insurance plans with set benefits and no deductible to meet.

.

Learn more about fixed-benefit indemnity insurance plan from our Supplemental Health Insurance Products Report or download our ebook on Accident and Critical Illness Insurance.