Affordable Care Act

Minimum Essential Coverage & 10 Essential Benefits

Updated on March 15, 2024

Share

Under the Affordable Care Act, it is critical for you to have minimum essential health coverage. What is minimum essential coverage? When we refer to the meaning of minimum essential coverage, we discuss the minimum level of health coverage you should have. Marketplace plans that are in compliance with the ACA are required to provide certain types of coverage. Read on to understand more about the Affordable Care Act’s minimum essential coverage standards.

What is minimum essential coverage?

When we talk about the meaning of minimum essential coverage, we are talking about qualified health plans (QHPs). Qualified health plans are plans that meet the minimum essential health coverage required by the Affordable Care Act. This includes providing coverage for pre-existing conditions, following limits related to cost sharing, and prohibiting lifetime and annual benefit limits. It is also important for these plans to provide 10 essential health benefits under the ACA.

Under the Affordable Care Act, major medical health insurance plans and qualified health plans (QHPs) must meet Minimum Essential Coverage Standards, which generally means they must:

- Have an “Actuarial Value” of 60% or more

- Cover 10 Essential Health Benefits

What are the 10 minimum essential coverage health benefits?

All major medical plans, including qualified health plans must cover 10 mandatory benefits, as explained in this video:

There are ten separate benefits that qualified health plans need to provide to be considered minimum essential coverage. They include:

- Laboratory Services: All qualified plans need to provide coverage for laboratory services. If you need to have a test run by a local laboratory, your insurance plan must cover the expense.

- Emergency Services: The plan should also provide coverage for emergency services. If you need to go to the emergency room, your insurance plan should cover the expense.

- Prescription Drugs: Your insurance plan should also provide coverage for prescription drugs. Prescription drug costs have been a significant issue during the past few years, and you should have coverage for both acute medications and chronic medications.

- Mental Health and Substance Use Services: All plans should also provide coverage for mental health and substance abuse services. For instance, if you suffer from anxiety or depression, your insurance plan should provide coverage for that. Your insurance plan should also cover the cost if you need to go to an inpatient unit because of substance abuse or mental health issues.

- Maternity and Newborn Care: A qualified plan should also provide maternity or newborn care coverage. If you are pregnant, your insurance plan should cover your prenatal expenses. It should also cover the cost of labor and delivery along with newborn care expenses.

- Pediatric Services: A qualified health plan should also provide coverage for pediatric services. This means care for children. This includes not only routine medical care but also dental and vision care.

- Rehabilitative Services and Devices: If you have been involved in an accident, you may require rehabilitation to restore functionality and mobility. A qualified plan should be able to provide coverage for this expense.

- Ambulatory Patient Services: Your insurance plan should cover the cost if you need ambulatory care. This refers to routine outpatient care, which includes urgent care visits.

- Preventive and Wellness Services: Your insurance plan should also provide coverage for preventive care. This means that if you need to go to the doctor for a routine physical, your insurance plan should cover the cost.

- Hospitalization: If you are sick and have to be hospitalized, your insurance plan should contribute to covering the cost. This can include routine inpatient hospital stays, surgical procedures, and stays in the intensive care unit.

It is important to look at every insurance plan’s details to ensure they provide coverage for these essential areas. Not every insurance plan will provide coverage for all of these issues, but if you get a qualified plan from the local marketplace, it should provide you with the coverage you need. If you have questions about the coverage provided by the insurance plan, you should reach out to an expert who can help you.

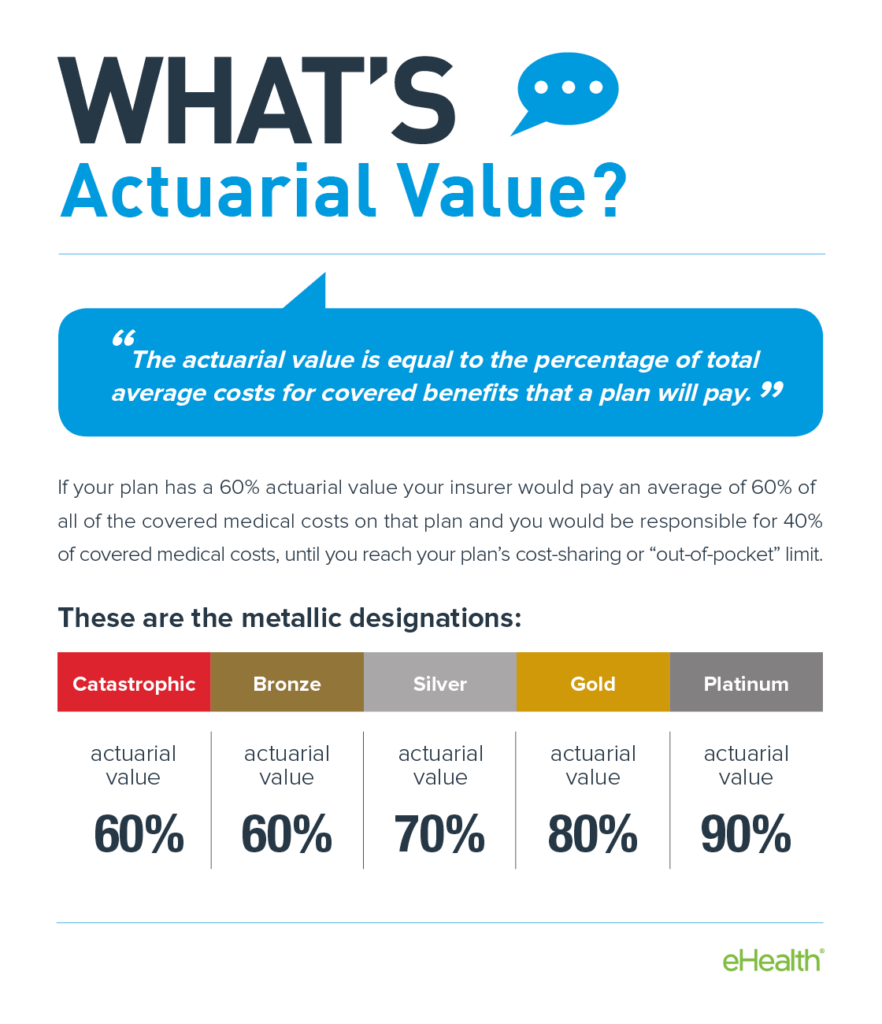

What’s actuarial value?

When searching for plans that meet minimum essential health coverage requirements, you need to look closely at the actuarial value of the insurance plan. This is a key component of the Affordable Care Act, as it directly relates to how much money you will have to pay if you have that plan.

The actuarial value refers to the percentage of average costs that are covered by the insurance plan. For example, if the insurance plan has an actuarial value of approximately 75 percent, then the patient will still be responsible for approximately 25 percent of the medical costs. The goal is to find an insurance plan with high actuarial value.

The value of the plans is directly related to the metallic levels of health insurance plans. A catastrophic or bronze insurance plan typically has a value of 60 percent. A silver plan has a value of 70 percent, while a gold plan has a value of 80 percent. Finally, a platinum plan has a value of approximately 90 percent or higher.

What will happen if I don’t get minimum essential coverage?

As of 2019, there is no longer a federal penalty for not having minimum essential coverage; however, there are a handful of states that still require individuals to maintain minimum essential coverage. These states are California, Massachusetts, New Jersey, Rhode Island, and Washington, D.C.

Also, keep in mind that the purpose of minimum essential health coverage is to ensure that individuals secure plans with good benefits. So another downside of not having minimum essential coverage is that you may have inferior health protection and miss out on valuable benefits.

How to find out whether you have minimum essential coverage

There are a few ways to determine whether you have minimum essential coverage. If you have an employer-sponsored health insurance plan, it must meet all minimum essential coverage requirements. Government plans also provide you with minimum essential coverage. If a plan only provides dental or vision, or if the plan is only designed to give you discounts, it does not meet MEC requirements.

How to get minimum essential coverage

In order to get minimum essential coverage, you may want to purchase a plan on the marketplace or you might want to get health insurance through your employer. If you need help accessing the features and benefits of individual insurance plans, the team from eHealth can help you.

Using eHealth, you can shop a wide range of health insurance plans and find qualified health plans that work for your preferences and needs. Take a look at our marketplace to browse and purchase plans that align with what you’re looking for.

Secure qualifying health coverage through eHealth

If you want to secure minimum essential coverage for yourself and your family, eHealth can help you. We are a one-stop shop for health insurance, and we can help you and your family secure essential coverage. Take a look at our options through our website or reach out to us to speak to a member of our team.