Short-term Insurance

ACA vs Short-Term Health Insurance

Updated on December 18, 2024

Share

Key Takeaways:

- ACA plans provide comprehensive, long-term coverage with essential health benefits and protections for pre-existing conditions.

- Short-term health insurance is a temporary, flexible solution but lacks comprehensive coverage and ACA compliance.

- Choosing between ACA and short-term health insurance depends on your health needs, financial situation, and coverage priorities.

ACA vs. Short-Term Health Insurance: What’s the Difference?

ACA health insurance offers full coverage with protections for pre-existing conditions, while short-term health insurance provides a temporary, sometimes lower-cost option with limited benefits. ACA plans are ideal for those needing comprehensive, long-term care and financial assistance, whereas short-term plans are suited for healthy individuals needing short-term coverage between jobs or enrollment periods. This article compares their key features, pros, and cons to help you decide which is best for your situation.

What Is ACA Health Insurance?

ACA health insurance, created under the Affordable Care Act, is designed to ensure all Americans have access to comprehensive health services. Key features include:

- Guaranteed issue: Insurers cannot deny coverage based on pre-existing conditions.

- Essential health benefits: Coverage includes preventive care, mental health services, maternity, and pediatric care.

- Income-based subsidies: Financial assistance lowers premiums and out-of-pocket costs.

- Caps on out-of-pocket expenses: Limits protect against financial strain for covered services.

Enrollment is typically available during the Open Enrollment Period (November 1 to January 15) or through a Special Enrollment Period triggered by life events like marriage, job loss, or childbirth.

What Is Short-Term Health Insurance?

Short-term health insurance offers a temporary solution for coverage gaps, such as between jobs or while waiting for other insurance to begin, and only provides limited coverage benefits. These plans are not required to meet ACA standards, meaning they often exclude pre-existing conditions and essential benefits.

Key features include:

- Lower premiums: Affordable but comes with higher financial risk due to limited coverage.

- Excludes pre-existing conditions: These plans do not cover pre-existing conditions or many essential health benefits.

- Not ACA-compliant: They lack protections such as guaranteed issue and may deny coverage based on health history.

Recent regulations limit short-term health plans to a maximum duration of four months in many states. Renewability is often restricted, with some states imposing stricter rules.

ACA vs Short-Term Health Insurance

Choosing the right health insurance plan can feel overwhelming, especially when faced with options as different as ACA health insurance and short-term health insurance. Both serve distinct purposes, but they vary significantly in terms of coverage, cost, and flexibility.

To help you make an informed decision, we’ve outlined the key differences in the table below. Whether you need comprehensive, long-term protection or a temporary safety net, this breakdown will give you a clear picture of what to expect from each option.

| Feature | ACA Plans | Short-Term Health Insurance |

| Coverage | Covers all essential health benefits, including preventive care, maternity, and mental health. | Limited temporary coverage, excludes essential benefits like maternity, prescription drugs, preventive care, etc. |

| Costs | Premiums can range without subsidies but are generally affordable with financial help. | Premiums can be affordable but offer less coverage and more financial risk. |

| Pre-Existing Condition Coverage | Guaranteed coverage for pre-existing conditions. | Does not cover pre-existing conditions or limits coverage for them. |

| Enrollment Periods | Enrollment is limited to Open Enrollment or Special Enrollment periods. | Available year-round, no restrictions on when you can apply. |

| Plan Duration | Coverage is annual, renewable each year with no gaps. | Coverage is temporary, typically only one to four months, and non-renewable in many cases. |

Pros and Cons of ACA and Short-Term Health Insurance

Understanding the pros and cons of ACA and short-term health insurance can help you weigh their advantages and limitations based on your specific needs.

ACA Pros:

- Comprehensive Coverage: Includes essential health benefits like preventive care, mental health, and maternity services.

- Financial Assistance: Subsidies and tax credits make it affordable for lower-income families.

- Pre-Existing Conditions: Guaranteed coverage for everyone, regardless of health history.

- Out-of-Pocket Limits: Caps on yearly expenses reduce financial strain.

- Family Plans: Ideal for families with varying healthcare needs.

- Preventive Care: Free access to many preventive services for early health issue detection.

ACA Cons:

- Premiums Without Subsidies: Can be expensive without financial assistance.

- Limited Enrollment: Only available during Open Enrollment or qualifying life events.

- Complexity: Plan options, subsidy eligibility, and networks can be confusing.

- Provider Networks: Some plans have limited doctor and hospital choices.

Short-Term Health Insurance Pros:

- Affordable Premiums: Lower monthly costs, can be ideal for tight budgets.

- Flexible Enrollment: Available year-round with no application restrictions.

- Quick Coverage: Perfect for gaps between jobs or waiting for ACA coverage.

- Customizable Duration: Tailored to your specific coverage needs.

- No Long-Term Commitment: Flexibility to drop coverage without penalties.

Short-Term Health Insurance Cons:

- Minimal Coverage: Excludes essential benefits like maternity and preventive care.

- Temporary Insurance: These plans only last from one to four months.

- High Financial Risk: Significant out-of-pocket expenses for uncovered services.

- No Pre-Existing Condition Coverage: Limited or no coverage for health issues before the plan starts.

- Regulatory Variability: Rules and availability vary by state.

- No Long-Term Security: Non-renewable plans often require re-enrollment.

- Coverage Denials: May be denied based on age, health status, or medical history.

- Limited Consumer Protections: Lacks federal safeguards like lifetime coverage caps.

When to Choose ACA vs. Short-Term Health Insurance

Choose ACA if:

- You need comprehensive, long-term coverage: ACA plans offer full health benefits, including essential services like preventive care and prescription drugs.

- You qualify for financial assistance: Subsidies and tax credits can lower premiums and out-of-pocket costs.

- You have ongoing health conditions or need family coverage: ACA plans cover pre-existing conditions and provide family coverage.

Choose Short-Term if:

- You need temporary coverage: Ideal for gaps between jobs or waiting for ACA coverage to start.

- You’re healthy and need a low-cost option: Offers basic, emergency-focused coverage, often at a lower price, but does not cover various ACA essential benefits such as preexisting or chronic conditions, mental health or addiction, pregnancy or childbirth.

- You missed ACA Open Enrollment: If you don’t qualify for a Special Enrollment Period, short-term plans can fill the gap.

Bringing It All Together

ACA plans offer robust, long-term coverage, making them ideal for individuals and families who need comprehensive healthcare and financial assistance. They provide essential health benefits and coverage for pre-existing conditions, ensuring peace of mind for ongoing health needs. On the other hand, short-term health insurance is an affordable and flexible option for those with temporary coverage needs, such as gaps between jobs or waiting for ACA coverage to begin. Ultimately, it’s important to assess your health needs, financial situation, and coverage priorities to choose the plan that best suits your circumstances.

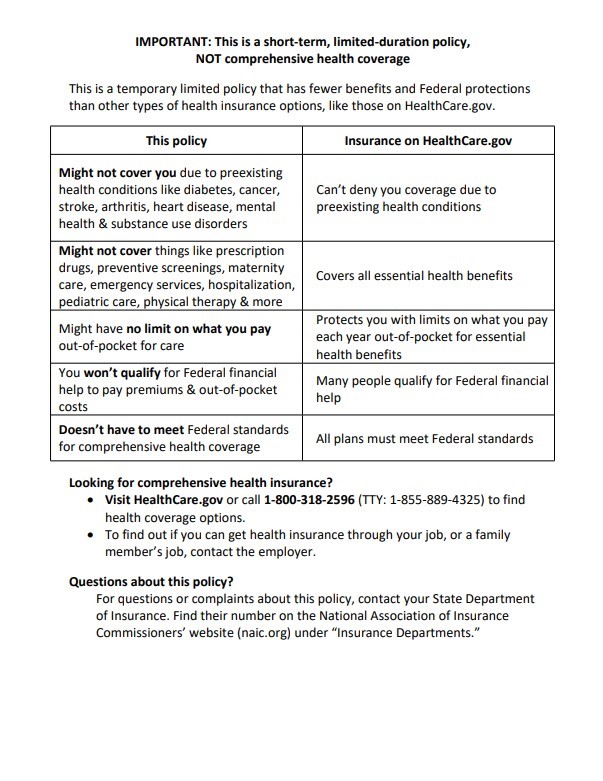

The following notice applies to short-term plans.