The Complete Small Business Insurance Guide

Even though eHealth focuses on small business health insurance, we’re here to support and inform our small business owners about more than just health coverage. One of the ways we do this is by offering relevant resources designed to help you run a successful and thriving small business, including this guide about major types of small business insurance.

As you lead your company, it is important to know what other kinds of commercial insurance your small business may need. Having the right types of small business insurance policies in place could help your company and employees with accident recovery, loss reduction, and strategic risk management.

What is small business insurance?

Small business insurance is a specific type of protection that small business owners need to have. You can use it to protect your property, income, and assets against certain threats. There are numerous types of insurance for small businesses. This includes general liability for small business owners, worker’s compensation insurance, and even health insurance. Small business health insurance providers are available to help business owners find the right small business health insurance for their employees. This is an important type of insurance that small business owners need to consider, and it could be helpful to consult a guide to small business health insurance to determine which type of insurance is right for your business.

Why is it important to have small business insurance?

Many small businesses that are just starting do not have a lot of capital on hand, so it is important to invest in small business insurance that can provide protection against catastrophic losses. It is important to take a look at a small business insurance guide to learn more about how business owners can protect themselves against natural disasters, lawsuits, and accidents. If small business owners are not careful, they could incur significant bills that might put them out of business, which is another reason it’s important to take a look at a small business insurance guide when shopping for insurance.

What are the major types of small business insurance?

- General liability insurance can protect a small business in case it is sued by a third party for injuries or damages.

- Errors and omissions or professional liability insurance can help defend a small business from claims related to negligence or inaccurate advice.

- Small business health insurance provides group health coverage and medical benefits for small business employees.

- Workers’ compensation insurance helps protect employees by paying for their medical care in case they are injured while working.

- Property insurance provides coverage for items and property used by a business, such as inventory or technology, in the event of physical disasters.

- Commercial auto insurance covers the cars and vehicles that employees use for work purposes.

- Commercial umbrella insurance is for incidents that go beyond the coverage a business already has through its other commercial insurance policies.

- A business owner’s policy (BOP) is a type of small business insurance package that combines coverage for most common property and liability insurance risks, as well as several other coverage areas.

What types of insurance do you need for a small business?

As a small business owner, you may be considering what types of small business insurance you need to provide for your company and employees. Nearly all small businesses choose to have general liability and property insurance, as well as workers’ compensation insurance if they have employees.

Other forms of small business insurance, such as small business health insurance or specific types of liability insurance, may be optional depending on the industry. Although companies may not be required to purchase every kind of small business health insurance out there, such policies can still protect small businesses from unexpected losses and accidents.

Overall, small business insurance policies often serve as valuable resources for employers by providing a safety net that shields businesses from liability and risk while helping them move forward in the face of uncertainty.

This guide to small business insurance will examine the major types of small business insurance, as well as the factors that influence average small business insurance costs.

What are the different types of small business insurance?

The major types of small business insurance available to employers include:

- general liability

- errors and omissions or professional liability

- small business health insurance

- workers’ compensation

- property, commercial auto, umbrella, and business owners’ policies

There are also other, more specialized forms of liability insurance, as well as additional types of commercial coverage and small business insurance.

General Liability Insurance

Most small businesses choose to invest in general liability insurance, which protects the company assets of small businesses in the event of being sued by a third party (any person or entity outside of the business). A general liability policy may help cover legal costs, as well as any settlement or award if your small business is sued.

A general liability insurance policy usually covers claims arising from the activities or operations of a small business, such as:

- Bodily injuries

- Property damages

- False advertising

- Libel and slander

Additionally, general liability insurance covers legal costs such as compensatory damages, non-monetary damages, punitive damages, legal defense costs, and settlements. Most general liability policies cover such claims whether they are filed by an individual or through a class-action lawsuit.

Since general liability insurance focuses on damage claims brought by a third party external to the business (like a customer slipping on a wet floor in a store), the policy typically does not cover employee medical expenses if they are injured on the job, or damage to property owned by the business. The high costs of lawsuits are one of the primary reasons why it is important for a small business to have general liability insurance. According to courtstatistics.org, the median costs for a premises liability suit can start at $54,000, with the trial phase of the suit being the costliest part of the litigation process.

A Small Business Association (SBA) Office of Advocacy report found that:

- The legal costs of actual litigation for small businesses ranged from $3,000 to $150,000.

- Approximately 36 to 53 percent of small businesses are involved in litigation each year.

The SBA report also noted that litigation’s impact on a small business can go beyond financial loss from damages and legal fees, often by contributing to significant emotional hardship for the business owner.

Overall, regardless of industry, many small business owners will likely consider choosing general liability insurance, since it protects their companies from the most common costs and risks associated with third-party litigation.

Errors and Omissions Insurance or Professional Liability Insurance

Errors and omissions insurance, also known as professional liability insurance, is a form of small business insurance that can help defend a business against financial losses from lawsuits and claims filed by customers and clients, as well as help pay for judgements or settlements.

Professional liability insurance covers claims such as negligence, inaccurate advice, misrepresentation, and violations of good faith. If your small business relies on using technical expertise to provide recommendations, advice, or any sort of physical care that may result in risks for customers, patients, or clients, then you will likely need this kind of small business insurance.

Since this same type of small business insurance policy is used throughout different professions, it can typically be referred to interchangeably with two different names: professional liability insurance or errors and omissions insurance. For example, malpractice insurance for doctors can also be called a medical errors and omissions policy.

Depending on state laws, lawyers and doctors are often required to have errors and omissions insurance.

Professionals from other industries that frequently use errors and omissions insurance or professional liability insurance include, but are not limited to:

- Financial advisors

- Insurance agents

- Real estate agents

- Accountants

- IT consultants

- Architects

- Engineers

When selecting an errors and omissions or professional liability insurance policy, your small business has two types of coverage options available:

- Claims made – In order to receive insurance protection, this form of coverage requires that the insurance policy is in effect both when the action occurred and when the lawsuit was filed.

- Occurrence – This type of coverage tends to have a higher cost; however, it will protect a small business even if the lawsuit in question happens after the small business insurance coverage has lapsed, as long as the action occurred during the time when the business was covered.

Given the especially serious nature of professional liability claims, errors and omissions coverage may be an essential form of small business insurance for industries specializing in expert advice and technical recommendations.

Small Business Health Insurance

Small business health insurance, also known as group health insurance, provides medical coverage and health benefits to employees. According to the Affordable Care Act (ACA):

- A small business is usually not required to offer group health insurance if it has less than 50 full-time equivalent employees.

- A business with 50 or more full-time equivalent employees is required to offer group health insurance coverage to its workers and pay at least 60 percent of employee premiums.

To qualify for small business health insurance, a business needs to have at least one full-time equivalent, common law employee who is not the owner, the owner’s spouse, or an independent contractor. A company must also be officially registered as a business according to its state’s regulations. A sole proprietor with no employees would not qualify for group health insurance, and would instead be eligible for an individual health insurance plan.

If an employer decides to offer small business health insurance coverage, then the employer is required to share the cost of monthly premiums with employees (usually 50 percent of premiums in most states, although businesses can choose to cover a higher percentage).

In most states, it’s up to the small business owner whether to cover the cost of premiums for employees’ dependents under the company’s small business health insurance plan.

There are different small business health insurance plan types, such as HMO, PPO, and POS plans, along with different metal levels that signify the different degrees of coverage for each plan.

Source: eHealth 2018 Small Business Health Insurance Report

One of the main advantages of small business health insurance for both employers and employees is that in a group plan, premiums per person tend to be more affordable on average compared to individual health insurance coverage.

Small business health insurance plans tend to have lower costs due to the risk pool advantage, a key insurance concept which means that when more people enroll and pay into a health plan, an insurance company is better able to spread the risks across the entire covered group, or “pool,” of individuals. As a result, the insurance company can more effectively cover the high cost of any one person’s medical services.

Other beneficial reasons to offer small business health insurance coverage include:

- Hiring talented prospective employees

- Greater employee loyalty and retention

- Potential tax incentives, such as deductions or tax credits

Source: eHealth 2018 Small Business Health Insurance Report

In addition to medical insurance, a business owner can also choose to offer other forms of small business health insurance, such as group dental and group vision plans, to his or her employees.

You can shop for small business health insurance plans through public or private health exchanges, or through a licensed insurance broker such as eHealth, which has the largest online marketplace for health insurance plans.

Workers’ Compensation Insurance

A small business can help protect its employees through workers’ compensation insurance coverage, which can pay for the medical care of an employee who becomes injured or ill while working, and may replace the employee’s partial wages. If an employee dies from work-related injuries, this type of small business insurance may be able to provide compensation for the employee’s family.

In most states, workers’ compensation insurance may be legally mandatory if a small business has at least a certain number of employees. According to the Insurance Journal, the majority of states require all businesses with one or more employees to have workers’ compensation insurance, while certain other states do not require employers to have coverage until they surpass a threshold number of employees (usually between 3-5 workers depending on the state).

Each state also excludes certain workers from workers’ compensation coverage; while these exclusions vary from state to state, examples may include farm workers and seasonal or casual workers. A sole proprietorship with no employees besides the owner may be exempt from workers’ compensation.

In addition to medical expenses, workers’ compensation insurance may cover related expenses, such as:

- Replacement income

- Retraining costs

- Living costs for permanent disabilities

- Survivor benefits in case of employee death

However, workers’ compensation insurance may not pay the full amount. Most of these sorts of claims are capped at particular maximums, and a business may need to pay a deductible or other forms of cost-sharing. It is important to note that workers’ compensation ends once the injured employee returns to work, and that workers’ compensation payments are usually tax-free.

Remember that workers’ compensation only covers accidents and illnesses that occur during the course of work. To help protect the health of employees outside of work, an employer could consider enrolling in a small business health insurance plan for their workers.

Workers’ compensation covers the majority of the nation’s workforce. According to a National Academy of Social Insurance report, workers’ compensation insurance coverage extended to an estimated 86.3 percent of all jobs in the employed workforce in 2015, comprising more than 135 million workers.

Not only is workers’ compensation a required type of small business insurance for most businesses with employees; it may also help shield a small business from bankruptcy if a worker becomes severely injured while on the job.

Property Insurance

Depending on the plan chosen, property insurance covers physical disasters, such as fire, theft, or vandalism. This type of small business insurance is especially relevant for a business that has a physical location or storefront. Property insurance provides coverage for property used by the business, including furniture, inventory, and technology, and will generally pay for restoration and repair costs.

A company may have the option to add business interruption insurance to its property insurance policy. For instance, if a fire caused a business to burn down, business interruption insurance could cover the resulting loss of income from the fire, while the property insurance covers the fire’s damages. Overall, small business insurance policies that provide coverage for property and interrupted income are important options for business owners to consider.

Commercial Auto Insurance

A small business that owns or uses vehicles is frequently required by law to have at least the state-mandated minimum level of commercial auto insurance, also called business auto insurance.

If an employee drives a car owned by the business and causes damage or injury, a commercial auto insurance policy would typically pay for the costs the business is liable for, up to the policy’s limit.

The two types of commercial auto insurance available to small businesses are:

- A traditional commercial auto insurance policy combines liability and property coverages for vehicles owned and used by a business.

- A hired and non-owned auto insurance policy is for businesses who have their employees drive their own personal or rented vehicles (which are not owned by the business) for work purposes.

Remember that some private auto insurance policies may not provide coverage if a car is used mostly for business purposes. Speak with a licensed small business insurance agent to find out if it makes sense to switch to a commercial auto insurance policy instead.

Overall, businesses that rely on vehicles for delivery, instruction, or employee transportation purposes may find commercial auto insurance to be a worthwhile choice of small business insurance coverage.

Commercial Umbrella Insurance

Commercial umbrella insurance is meant for incidents that go above the coverage a small business already has through its other forms of insurance. For instance, if a business was sued for $2 million, and its general liability insurance only covered the business for $1 million, then commercial umbrella insurance would be able to cover the remaining $1 million.

Typically, umbrella insurance may also be applied to other types of liability and small business insurance. Overall, it may make sense for a small business to consider commercial umbrella insurance if the company faces the risk of major suits or losses.

Business Owner’s Policy (BOP)

A business owner’s policy (BOP) is a type of small business insurance package that combines coverage for the most common property and liability insurance risks, as well as several other coverage areas. Since a BOP is a bundled form of small business insurance, it may be a cost-effective choice for small businesses that want to make sure they have essential commercial insurance coverage.

With a BOP, a small business can also decide to select additional types of insurance to add to its policy, thereby creating a customized range of coverage. For example, a business owner’s policy might only include general liability insurance and not professional liability insurance; however, employers would likely have the option to add professional liability coverage to their BOP. Thus, a business owner’s policy may help companies find a more affordable solution for their small business insurance coverage needs.

Additional types of small business liability insurance

There are many forms of specialized liability insurance that small businesses can consider. Some common examples include small business insurance for liabilities related to:

- Cyberattacks and data breaches

- Products

- Directors and officers

- Employment practices

- Liquor-related incidents

Cyber Liability Insurance

As a relatively recent form of small business insurance coverage, cyber liability insurance is becoming more significant due to the rise of digital threats. The purpose of cyber liability insurance is to protect businesses’ digital data from online risks such as hacks, data breaches, and cyber extortion. This kind of small business insurance will be important for specific kinds of businesses.

Cyber liability insurance is probably an essential form of small business insurance coverage for companies that manage the personal data of customers, including their credit cards, financial accounts, medical records, or contact information.

According to a 2019 report conducted by The Hanover Insurance Group and Forbes Insights, 18 percent of small business owners reported facing a data breach incident in the past 5 years, while 63 percent of small business owners who faced a cyber breach claim expect to face another claim in the next 5 years. Additionally, 67 percent of small employers agreed that as their businesses become more digital, they become more vulnerable to cyber security incidents, according to the report.

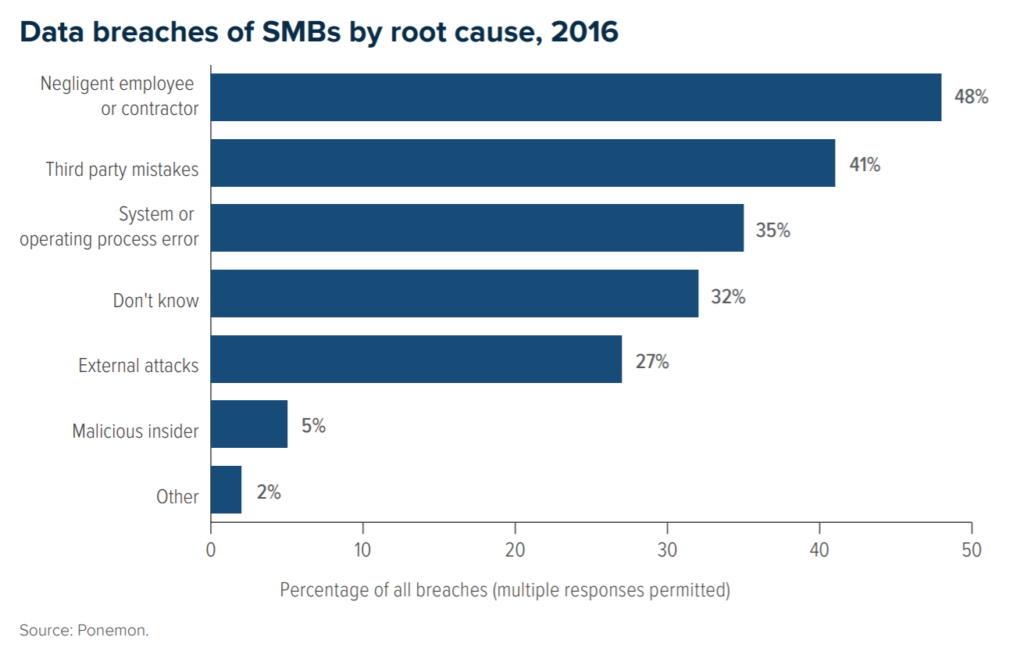

Small business owners should keep in mind that hacking is not the only way that their company’s data can be compromised. According to a survey of small to medium-sized businesses in a Ponemon Institute Research Report, negligent employees or contractors (48 percent) and third party mistakes (41 percent) were the most common causes of data breaches in 2016.

Source: Ponemon Institute / Insurance Information Institute

Ultimately, cyber liability insurance may be an important tool for small businesses from a variety of industries that seek to protect the information of their clients and employees.

Product Liability Insurance

A product liability insurance policy applies to injuries and damages resulting from the use of products made, sold, or transported by a business. This type of small business insurance typically provides more specific protections from product-related legal claims than general liability policies, which tend to have limited coverage for product liability claims.

Examples of businesses that may benefit from a product liability insurance policy include:

- Manufacturers

- Distributors

- Wholesalers

- Transporters

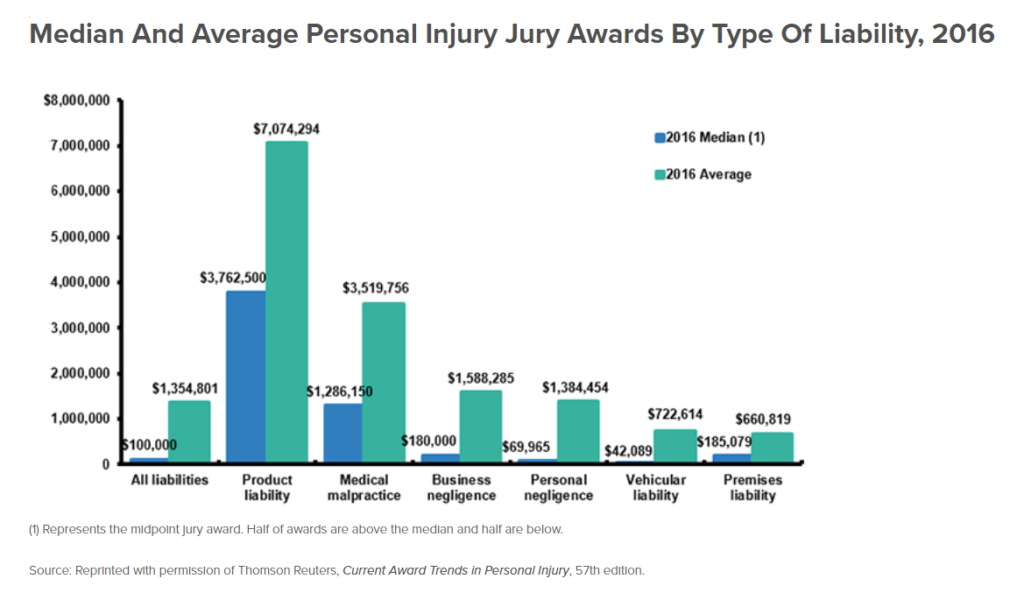

Depending on the industry and business type, product liability claims may be especially costly for a business. According to information gathered by the Insurance Information Institute, lawsuits from product liability claims can be considered one of the most expensive types of litigation, based on the personal injury awards given by juries.

Source: Insurance Information Institute

Given the potentially high legal costs and personal injury awards arising from product liability claims, a product liability policy may be an especially significant type of small business insurance for companies in particular industries.

Directors and Officers Liability Insurance

This form of liability insurance can specifically protect the directors and officers of corporations and organizations in the event of a lawsuit that claims they conducted business without regard for the rights of shareholders or others.

Since leaders are exposed to additional risks by becoming directors or officers, businesses may choose to acquire this type of small business insurance. Directors and officers liability insurance policies usually do not cover illegal activities or poor business decisions.

Employment Practices Liability Insurance (EPLI)

Employment Practices Liability Insurance (EPLI) is a type of small business insurance that can cover damages for violating the civil or legal rights of an employee, up to the policy’s limit. An EPLI policy may offer coverage for different employee lawsuit claims, such as:

- Discrimination

- Harassment

- Wrongful termination

- Breach of employment contract

Employment Practices Liability Insurance would typically reimburse a business against litigation, legal costs, judgments, and settlements resulting from employment practices-related lawsuits.

Liquor Liability Insurance

If your business is a bar, or sells liquor in some form, you may want to pay extra attention to this small business health insurance policy. General liability insurance policies often exclude alcohol-related incidents. As a result, a small business that sells or serves alcohol may need to purchase liquor liability insurance coverage. In fact, many states require businesses to have liquor liability insurance in order to acquire a liquor license.

A liquor liability insurance policy may include coverage for incidents such as:

- Altercations between intoxicated customers

- Related occurrences of assault and battery

- Intoxicated customers causing DUI accidents

- Workers drinking while on the job

- Witnesses’ mental injuries from an incident

Note that the specifics regarding what incidents are covered by liquor liability insurance vary depending upon the location of a business; this is due to each state having its own legal and evidence requirements related to third-party injuries.

If a small business decides to offer alcohol at occasional company events, then it has the option to purchase a liquor liability insurance policy that only provides coverage for those occasional events, and may have lower premiums as a result.

Other types of small business insurance

Each small business has its own unique priorities as well as risks. Additional types of relevant small business insurance can provide effective coverage for:

- Key employees

- Identity theft

- Terrorism

- Flooding

Key Employee Insurance

Key employee insurance can help provide compensation for a business if one of its key employees dies or becomes disabled. Examples of key employees include executives and leaders who play a major role in a business and cannot be readily replaced. Key employee insurance may reduce the negative impact of losing a critical employee through financial assistance, and could be especially valuable for businesses, which need to prioritize succession and continuity planning.

Business Identity Theft Insurance

Identity theft insurance can help protect small businesses and corporations when facing issues that involve identity theft and related types of financial fraud. Depending on the policy, identity theft insurance coverage may help with recovery via assistance with legal and resolution services.

According to a report by the Consumer Sentinel Network, which is organized by the Federal Trade Commission (FTC), of the nearly 3 million reports received in 2018, 1.4 million (or 48 percent of all reports) were fraud-related, while 444,602 reports (15 percent) were related to identity theft. The report also found that credit card fraud was the most frequent form of identity theft in 2018.

Source: Consumer Sentinel Network Data Book 2018 / Federal Trade Commission

Terrorism Insurance

The Terrorism Risk and Insurance Act of 2002 (TRIA) requires the owners of specific types of commercial property to offer business owners the opportunity to buy insurance coverage against terrorist attacks. The TRIA also included a requirement that business owner’s policies (BOPs) offer terrorism insurance in their packages, although small business owners are not required to purchase this form of coverage.

Commercial Flood Insurance

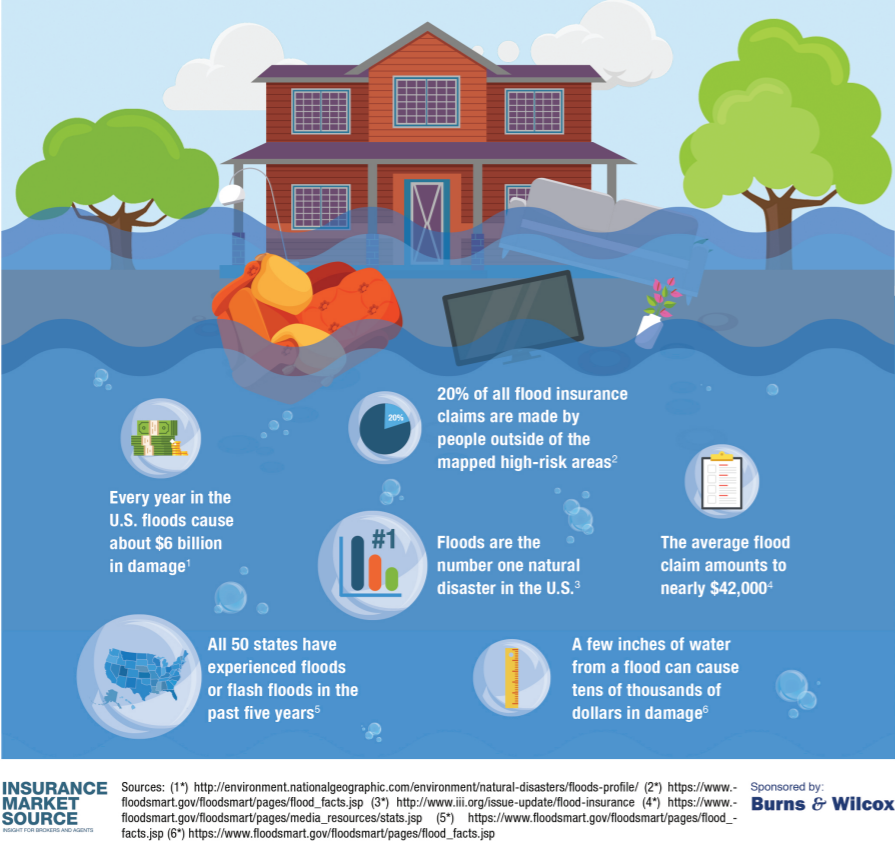

Commercial flood insurance can provide coverage for a small business in the event of water damage resulting from floods. The purpose of this small business insurance is protect areas of a building and property that may be affected by flooding, such as walls, floors, ceilings, equipment, and inventory.

Source: Insurance Market Source

Even companies located in areas that are not prone to seasonal flooding can still be affected by flood damage from unexpected sources, such as melted snow, clogged drainage systems, or flash flooding from unusually severe rainfall or storms. If a business’ commercial property insurance does not already include coverage for floods, then it may be worth considering the purchase of this type of small business insurance.

How much is small business insurance?

The average cost of small business insurance depends on several key factors, including:

- Industry and perceived risk – Certain industries, such as those that involve working with heavy machinery, face greater risks and hazards than others. As a result, industries with higher potential for injuries are more likely to have higher small business insurance premiums.

- Scale of the business – A business with a larger amount of employees may face a greater likelihood of risks than a business with fewer employees. Similarly, factors such as the condition and size of the business’ property or building also play a key role in determining insurance costs.

- Location of the business – Location-based factors that influence the cost of small business insurance include municipal and state laws and the regional frequency of natural disasters.

- Claims history – A business with few insurance claims may pay lower premiums compared to a business with a higher number of claims. For example, a business with fewer workers’ compensation claims may be conducting its operations more safely than other companies, and thus may have a lower insurance premium.

Overall, small business insurance costs will vary depending on the type of small business insurance chosen, as well as the unique needs and characteristics of each business.

Where to find small business insurance

While small business insurance coverage may be complex, finding the right policy shouldn’t be. When searching for small business insurance, your best source of information will be a professional licensed insurance broker. Brokers can provide relevant information that can help you choose the optimal small business insurance coverage for your company, based on your budget, industry, risk factors, and preferences.

If your small business decides to offer group health insurance, eHealth can help you shop for quality health plans at affordable prices. Our website makes it easy to compare and shop for small business health insurance with free, no obligation quotes, and our licensed health insurance agents can help answer your questions with insightful, unbiased advice. Visit eHealth.com to learn more about your options for effective small business health insurance coverage for yourself and your employees.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.