Individual and Family

Can You Change My Health Insurance Plan After Enrollment?

Published on November 12, 2024

Share

Key Takeaways:

- You can change your health insurance plan during the Open Enrollment Period, typically from November to January.

- Special Enrollment Periods allow changes after major life events like marriage, childbirth, or job loss.

- Without a qualifying event, you’ll need to wait until the next Open Enrollment. If you have a qualifying event, you generally have 60 days to act to avoid gaps in coverage

Yes, you can switch your health insurance plan after enrollment, but it depends on timing. During the Open Enrollment Period (OEP), you’re free to make any changes you need. Outside of that window, though, you can only change plans if you qualify for a Special Enrollment Period (SEP). This can happen after certain life events, like getting married, having a baby, or losing your job. Without one of these qualifying events, you’ll need to hold tight until the next Open Enrollment Period.

Understanding Enrollment Periods

The Open Enrollment Period (OEP), usually from November 1st to January 15th in most states, is when you can sign up for or switch your health insurance plan. If you miss this window, you can still make changes if you qualify for a Special Enrollment Period (SEP), which opens after major life events like getting married, losing a job, or welcoming a new baby.

Special Enrollment Periods and Qualifying Life Events

If you experience a Qualifying Life Event (QLE), such as marriage, having a baby, or losing your coverage, you may qualify for a Special Enrollment Period (SEP). This generally gives you a 60-day window to change your health insurance plan and shop for new ACA-compliant coverage, either through the Marketplace or off-market options.

Be sure to act within this 60-day window, as enrolling in time ensures your coverage will begin on the 1st of the following month. Missing the deadline means you’ll have to wait until the next Open Enrollment Period to make changes to your plan.

Key Considerations Before Switching Plans

Before switching health insurance plans, take a close look at how it will impact your coverage and costs. Think about doctor networks, prescription benefits, and out-of-pocket expenses like deductibles and copays. While a new plan might have lower premiums, it could mean higher costs elsewhere if the coverage is more limited.

Comparing different plans based on premiums, essential services, and flexibility with in-network and out-of-network providers will help you find the best fit. Also, keep in mind that some states have unique rules that can affect your options, so be sure to check out any state-specific details.

How to cancel your plan without replacing it

To cancel your Marketplace plan without replacing it, simply login to your HealthCare.gov account or contact your insurance provider directly. Follow the steps to cancel your plan, ensuring that your coverage will end on the desired date. Keep in mind that once your plan is canceled, your coverage will stop immediately or at the end of the billing cycle, depending on the plan’s terms.

Before making the final decision, review your health insurance needs to ensure this is the best option for your current situation.

Report a change to get a Special Enrollment Period

If you qualify for a Special Enrollment Period, report the change as soon as possible to secure any savings you may be eligible for. You’ll have 60 days to enroll in a new plan. It’s important to report the change as soon as possible to ensure you receive any savings you qualify for with your Marketplace plan.

Here are the steps to follow if you qualify:

- Report the Change: Update your Marketplace application to reflect your life event (e.g., marriage, childbirth, or job loss). You may need to provide documentation as proof of the event.

- Check Eligibility: Review your eligibility results to confirm if you qualify for a Special Enrollment Period. This step will also determine if you’re eligible for financial assistance, such as premium subsidies.

- Choose Your Plan: Compare available plans and select one that meets your needs. Consider factors such as doctor networks, out-of-pocket costs, and prescription coverage before enrolling.

Considering Cancellation and Alternatives

If you’re considering canceling your health insurance, understand the risks and alternatives:

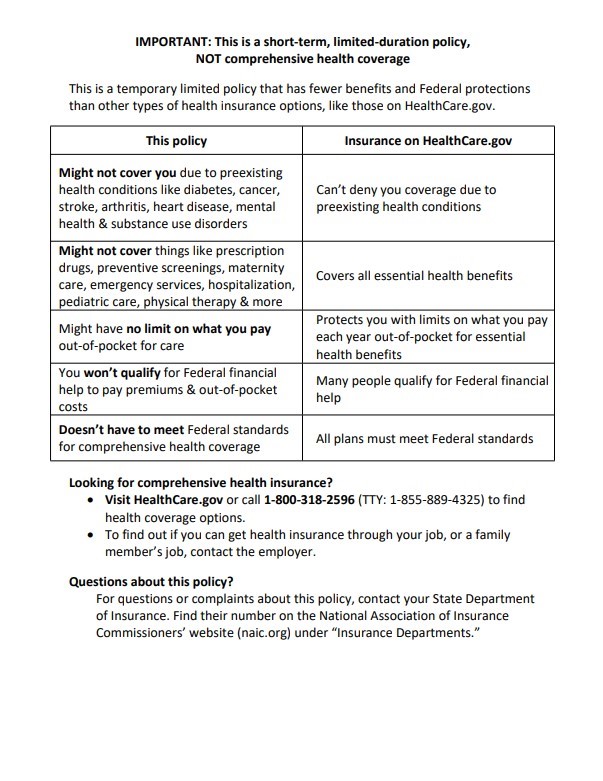

- Exploring Short-Term Health Insurance: Short-term plans can be a temporary option if you’re between jobs or waiting for the next Open Enrollment Period. However, these plans often offer limited coverage and may not cover pre-existing conditions or essential health services like maternity care or prescription drugs.

- Canceling Without Coverage: Canceling your plan without replacing it leaves you vulnerable to unexpected medical expenses. You’ll likely have to wait until the next Open Enrollment Period to re-enroll unless you qualify for a Special Enrollment Period.

- Financial Impact: Going without health insurance can result in paying full costs for medical services, which could be a significant financial burden if unexpected health issues arise.

Bringing it all together

You can switch your health insurance plan after enrollment, but it depends on timing and qualifying events. During Open Enrollment, you’re free to make changes. Outside that, you’ll need to qualify for a Special Enrollment Period due to life events like marriage, having a baby, or losing coverage. Act quickly to avoid any gaps in coverage.

If you do qualify, remember to act within 60 days of the event to prevent any gaps in coverage. Before making any changes, take a close look at how a new plan will impact your coverage, costs, and overall healthcare needs.

If you choose a short-term plan, please see the following notice regarding short-term plans: