Individual and Family

What is a Qualifying Life Event?

Updated on December 18, 2024

Share

Key Takeaways:

- Qualifying Life Events (QLEs) like marriage, job loss, or moving trigger a 60-day Special Enrollment Period (SEP), allowing individuals to enroll in or adjust health insurance outside of Open Enrollment.

- QLEs require specific documentation, such as a marriage certificate or proof of address change, to verify eligibility for SEP, ensuring a smooth enrollment process.

- If you don’t qualify for SEP, alternative options like Medicaid, COBRA, or short-term health plans can help bridge coverage gaps until the next Open Enrollment Period.

A Qualifying Life Event (QLE) is a significant life change that grants individuals the ability to enroll in or adjust their health insurance outside the standard Open Enrollment Period. QLEs typically include events such as marriage, birth or adoption of a child, job loss, or moving to a new coverage area.

A QLE triggers a Special Enrollment Period (SEP), a time-limited opportunity (usually 60 days) for eligible individuals to modify or start a new health plan in response to the life event. This ensures that people can maintain or change their coverage as life circumstances evolve.

QLEs are crucial for accessing or updating health coverage when unexpected life events occur outside of Open Enrollment. This flexibility is especially valuable to secure or maintain appropriate healthcare benefits, regardless of the timing of the change.

Categories of Qualifying Life Events

QLEs fall into four basic categories, covering a wide range of life changes:

- Loss of Health Coverage: This includes losing job-based, individual, or student health plans, aging out of parental coverage at 26, or losing eligibility for programs like Medicare, Medicaid, or CHIP.

- Changes in Household: Major family changes, such as marriage, divorce, birth or adoption of a child, or the death of a family member, may qualify as a QLE.

- Changes in Residence: Moving to a new ZIP code or county, relocating for school, seasonal work, or transitioning from shelter housing qualifies as a QLE if it affects your coverage options.

- Other Qualifying Events: Various special circumstances, like income changes impacting eligibility, gaining U.S. citizenship, leaving incarceration, or starting/ending AmeriCorps service, may open eligibility for SEP.

How to Enroll After Experiencing a QLE

After a Qualifying Life Event (QLE), such as losing job-based coverage or moving, you’re eligible for a 60-day Special Enrollment Period (SEP) to sign up for or change health insurance. Missing this window means waiting until the next Open Enrollment Period to enroll. During the SEP, you can choose any Marketplace plan tier (Bronze, Silver, Gold, or Platinum), and income-based subsidies may be available to reduce costs.

Here’s how to get started:

- Verify Eligibility: Confirm your QLE with your health insurance provider or the Health Insurance Marketplace to ensure it qualifies for SEP.

- Begin Enrollment: Go to your insurance provider’s website or visit Healthcare.gov if you’re enrolling through the Marketplace. You may also speak with a licensed insurance agent for guidance.

- Submit Documentation: Some QLEs require documentation, like a marriage certificate, birth certificate, or proof of coverage loss. Upload these directly or provide them as directed by your insurer.

- Choose a Plan: Review available plans in your area. During the SEP, all Marketplace plans are available, including those with subsidies if you qualify.

- Complete Enrollment: Finalize your selection and submit payment. Ensure coverage starts within 60 days from your QLE, as that’s typically the SEP window.

Documentation Needed for QLEs

To verify a Qualifying Life Event (QLE) and activate a Special Enrollment Period (SEP), you’ll need specific documents based on the event type. Proper submission of these documents helps ensure a smooth approval process.

Common Documents by QLE Type:

- Loss of Health Coverage:

- Termination letter from employer or insurer showing end date of coverage.

- COBRA eligibility notice, if applicable

- Household Changes (Marriage, Divorce, Birth, Adoption, Death):

- Marriage certificate or divorce decree.

- Adoption records or birth certificate.

- Death certificate if removing a dependent.

- Changes in Residence:

- Rental agreement, mortgage statement, or utility bill in your name for the new address.

- School records or employer letter verifying new location if relocating for work or school.

- Other Life Changes (Income changes, citizenship, release from incarceration):

- Pay stubs or income statements showing income change.

- Naturalization certificate for citizenship status.

- Release paperwork from the incarceration facility.

Tips for Smooth Submission and Approval:

- Ensure Accuracy: Double-check that documents match your personal details and QLE information on your application.

- Submit Promptly: Upload or mail documents as soon as possible to avoid delays.

- Follow-up: Keep an eye on your account for confirmation or requests for additional information.

What If You Do Not Qualify for SEP?

If you don’t qualify for a Special Enrollment Period (SEP) after a Qualifying Life Event (QLE), other health coverage options are available:

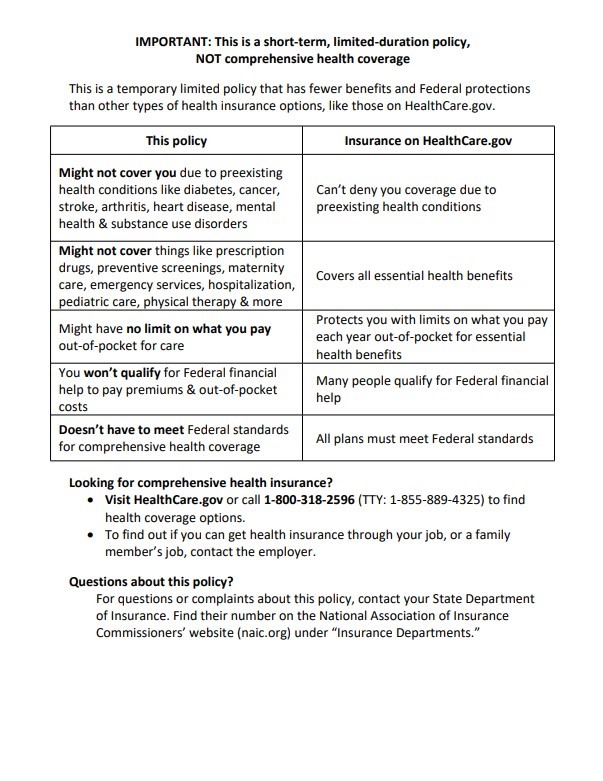

Short-Term Health Plans

Short-term plans are temporary, non-comprehensive health plans, typically lasting 1-4 months, and are designed for coverage gaps. Keep in mind they do not cover essential health benefits or pre-existing conditions.

Medicaid

Based on income, Medicaid offers comprehensive health coverage year-round, even outside of the Open Enrollment Period. Eligibility depends on household income, state guidelines, and sometimes, individual circumstances like disability or pregnancy.

COBRA

For those leaving employer-based coverage, COBRA lets you stay on your previous employer’s plan for up to 18 months. While comprehensive, COBRA can be costly as you cover the full premium.

Bringing It All Together

QLEs are crucial for accessing health insurance outside the Open Enrollment Period, providing flexibility during significant life changes like marriage, moving, or job loss. Acting quickly within the 60-day Special Enrollment Period (SEP) after a QLE is essential to avoid gaps in coverage. Reviewing your options, understanding required documentation, and preparing for changes can help you stay covered and minimize unexpected costs.

FAQs

How soon can I get coverage after a Qualifying Life Event?

Coverage usually begins on the first day of the month after selecting a plan. For QLEs like birth or adoption, coverage can start retroactively from the event date.

What happens if I miss the 60-day Special Enrollment Period?

If you miss the 60-day window, you’ll generally need to wait until the next Open Enrollment Period to sign up for a plan unless you qualify for another SEP.

What if my Qualifying Life Event is related to income change?

A change in income may make you eligible for a Special Enrollment Period or for Medicaid/CHIP. Proof of income change is required to determine eligibility.

Can I add dependents during a Special Enrollment Period?

Yes, you can add dependents, such as a spouse or new child, during a Special Enrollment Period triggered by events like birth, adoption, or marriage.

The following notice applies to short-term plans.