Short-term Insurance

What Do Short-Term Plans Cover?

Published on July 09, 2024

Share

If you recently lost your job or experienced a lapse in coverage, you may consider applying for a short-term health insurance policy to bridge the gap. These plans can be particularly appealing if you don’t qualify for premium subsidies in the health insurance Marketplace, missed open enrollment, or are in a transitional phase, such as between jobs, retiring before Medicare eligibility, or waiting for other insurance (like an employer’s plan or an ACA-compliant individual market plan) to commence. While short-term policies can provide critical coverage during challenging times, they are not designed as a long-term healthcare solution and will not offer the same level of coverage as your long-term insurance policy.

If you are interested in learning more about what short-term plans cover, read on. This guide will provide an in-depth look at short-term health insurance.

What is a Short-Term Health Insurance plan?

Short-term health plans offer Americans a way to get coverage temporarily from one to three months, often with an option to renew for one additional month. That means you can keep your short-term care for a maximum of four months in some circumstances.

Short-term health plans are specifically designed to bridge the gap between permanent policies. You might consider a short-term plan if you are:

- Between jobs and don’t want to pay high COBRA health insurance premiums and cannot afford an ACA plan even with available subsidies

- Waiting to become eligible for Medicare

- In need of coverage until the Open Enrollment Period begins

- Have a loss in coverage without qualifying for a special enrollment period

- Not yet eligible for a major medical plan through your employer

Short-term plans do not have to follow all the coverage requirements of the Affordable Care Act (ACA). Until 2019, people with these plans could be assessed a federal tax penalty since short-term plans are not considered qualified plans. In 2019, the federal tax penalty was waived, allowing more people to have a short-term plan without worrying about a tax penalty, although some states may still have a state tax penalty.

Because of the changes in government rules, the term for short-term health insurance has been reduced from 12 months to only three months starting September 1, 2024. Some plans may allow a one-month renewal, so you can now only have short-term insurance for up to four months in total if you qualify for a renewal. You can sign up for these plans any time and coverage usually starts quickly once you sign up.

What do short-term plans cover?

Coverage for a short-term plan is different from what is covered with a major medical plan that complies with the ACA. Short-term plans usually only cover services and treatments related to unexpected illness or injury. Coverage might include:

- Outpatient visits to the doctor

- Emergency room visits

- Hospital stays

- Surgeries required for illness or injury

- Related x-rays and laboratory services

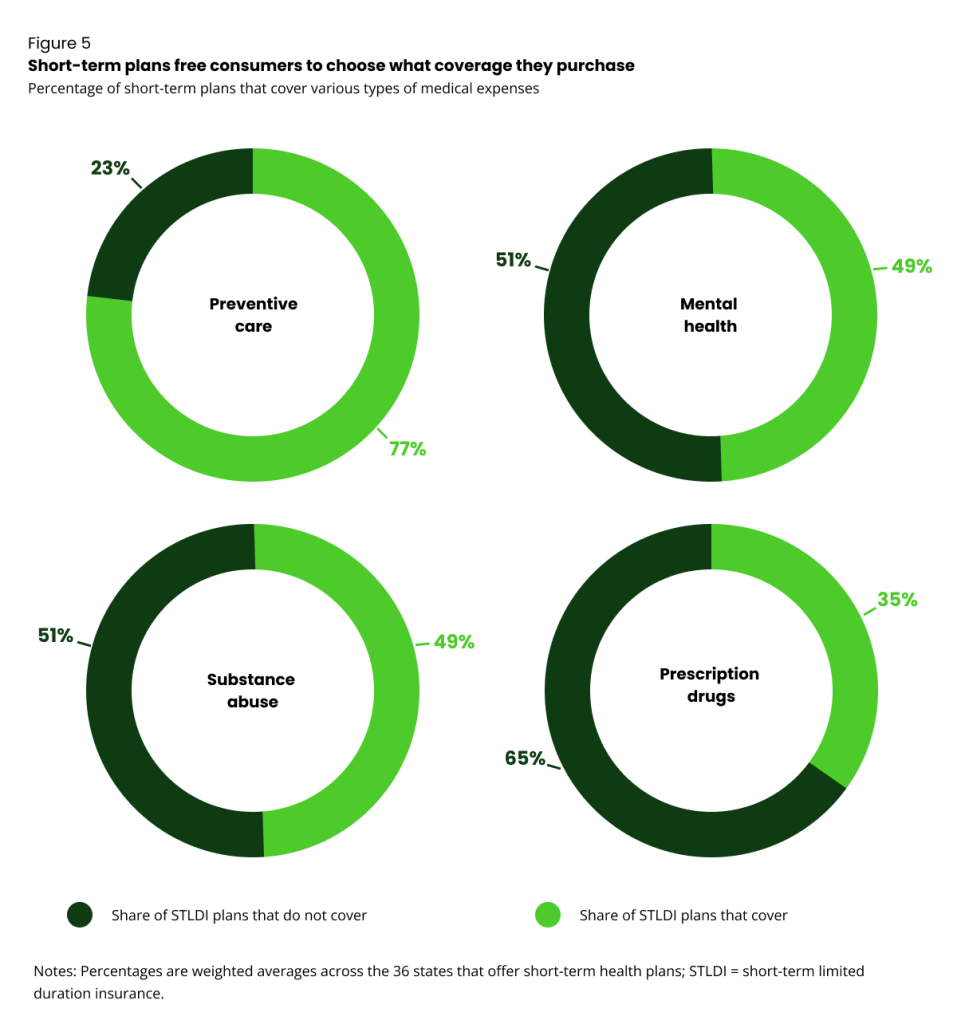

https://www.cato.org/policy-analysis/biden-short-term-health-plans-rule-creates-gaps-coverage#choice

Coverage limits and exclusions with short-term plans

Keep in mind that short-term plans do not include all your routine medical needs. They also do not cover pre-existing conditions or maternity coverage. Many plans do not offer preventative, vision, dental, or mental health care benefits. Specifics will depend on the plan you choose and the company providing the plan. The licensed agents at eHealth can help you select the best short-term plan for your needs and budget.

Short-term health insurance is designed to provide temporary coverage for basic medical services, which can include some emergency care, urgent care, and in some cases, limited specialist consultations. However, it is important to note that these plans are not comprehensive. Unlike Marketplace plans, short-term insurance typically does not cover preventive services, which are crucial for maintaining health and detecting early signs of illness. Furthermore, coverage for specialist care and diagnostic services is often limited if included at all, and these limitations can result in significant out-of-pocket expenses for anything beyond basic medical care. This type of insurance is best suited for filling gaps between more robust policies rather than serving as a long-term health insurance solution.

FAQs about what short-term plans cover

What are the differences between short-term and ACA-compliant plans?

The ACA-compliant medical insurance plans are much more extensive than short-term insurance and can last for longer terms. With these “Obamacare” plans, you can’t be denied coverage or denied the minimum essential health benefits these plans must cover.

The ten minimum essential health benefits are:

- Outpatient care

- Prescription drugs

- Emergency services

- Mental-health and addiction treatment

- Hospitalization

- Rehabilitative services and devices

- Preventive, wellness, and chronic disease treatment

- Laboratory services

- Pediatric care

- Maternity and newborn care

Plans can offer additional benefits, but these ten must be included in any ACA-compliant plan. When you enroll in one of these plans, you can rest assured that most of your basic healthcare needs will be covered.

You can’t apply for the ACA-compliant medical plans at any time of year, as you can with short-term insurance. To apply for one of the ACA medical plans, you must enroll during the Open Enrollment Period or during a Special Election Period (if one opens up for you because of a significant life event, such as getting married or divorced, giving birth, adopting a child, or moving). When applying for an Obamacare plan, you also can’t be declined for coverage, even if you have pre-existing conditions.

Short-term plans offer a limited policy that offers fewer benefits and federal protections compared to more comprehensive health insurance options available on HealthCare.gov and ACA plans. It may exclude coverage for preexisting conditions such as diabetes, cancer, stroke, arthritis, heart disease, and mental health and substance use disorders. Additionally, the policy might not cover essential health services including prescription drugs, preventive screenings, maternity care, emergency services, hospitalization, pediatric care, and physical therapy. There is often no cap on what you pay out-of-pocket for care, and you won’t qualify for federal financial assistance to help with premiums and out-of-pocket costs. Furthermore, this type of insurance does not need to meet federal standards for comprehensive health coverage.

Can I get a short-term plan in my state?

Short-term plans are only available in many states. However, there are some states that don’t sell these plans, including: Washington, California, Colorado, New Mexico, Hawaii, New York, Vermont, New Hampshire, Maine, Massachusetts, Connecticut, New Jersey, and District of Columbia. Only 36 state offer short-term plans in 2024.

What are the additional insurance options with a short-term plan?

Some people who enroll in short-term insurance plans purchase other forms of insurance simultaneously. This offers additional coverage for services not covered by the short-term plan.

One option is accident insurance, which offers cash payments for covered health services. You can use the cash to pay for hospital stays, examinations, and visits to the emergency room. You can also use this coverage for temporary house and transportation costs associated with your healthcare needs.

Critical illness insurance covers you if you are diagnosed with a critical illness, like a stroke, heart attack, or cancer. This insurance coverage pays a lump sum to cover costs associated with these health events.

What can people do when their short-term policy terminates?

The length of short-term health insurance policies is limited to three months, with a possibility for a fourth month if a renewal is permitted. Starting from September 1, 2024, any new short-term policy can only last a maximum of four months (if renewed), meaning it can only last at most until the end of 2024. Insurers could offer even shorter policies, such as a three-month plan that you cannot renew.

If you purchase a short-term policy by August 2024, the duration can generally vary from six months to 12 months, depending on the plan you choose and the limitations in your state. If you start a six-month policy on August 15, 2024, it will end in mid-February 2025, after the open enrollment period for ACA-compliant plans has ended. This would mean you can’t switch to an ACA-compliant plan unless you experience a qualifying life event that allows for special enrollment. Note that short-term plans are not considered minimum essential coverage, and your ability to get another short-term plan after yours ends may depend on your health status, as new insurers could evaluate your medical history.

Find the right short-term plan for you with eHealth

Short-term insurance plans are meant to fill in a lapse in coverage, such as if you’re waiting for Medicare eligibility, cannot apply during the Open Enrollment Period, are laid off, or until you qualify for your work’s policy. This type of temporary coverage tends to only last for a maximum of three months with a chance to renew for one additional month. While the coverage is not very comprehensive, short-term health insurance covers emergency surgery expenses due to unexpected injuries or illnesses. Keep in mind that short-term health insurance plans aren’t for everyone, nor are they available in every state.

There are numerous options for short-term health plans available today. It can be intimidating to select the best plan for your needs and budget, even if the benefits will be temporary. At eHealth, we help you compare short-term health insurance plans to ensure you can find the best plan for your unique needs. Our certified, licensed agents are also available to assist you in your search for healthcare coverage at no additional cost to you.

When you need quick short-term coverage customized to your precise situations, eHealth can help. eHealth can also provide support when it becomes time to look for a long-term health insurance plan. Speak with a licensed agent online or over the phone today to find the right plan for you.