Short-term Insurance

What is Short-Term Health Insurance?

Updated on December 18, 2024

Share

Key Takeaways:

- Short-term health insurance provides temporary, limited coverage for unexpected medical events, typically lasting one to four months.

- These plans exclude pre-existing conditions and essential health benefits like preventive care or mental health services.

- Ideal for gaps in coverage but lacks consumer protections and subsidies offered by ACA-compliant plans.

What Is Short-Term Health Insurance?

Short-term health insurance (STLDI) is a temporary health plan designed to provide limited coverage during transitional periods, such as between jobs or waiting for ACA-compliant insurance. These plans are not ACA-compliant, typically last one to four months, and offer quick enrollment with minimal underwriting. They often exclude pre-existing or chronic conditions and provide limited or no essential health benefits such as preventive care, mental health, or pregnancy and childbirth.

Recent federal rules now limit short-term plans to a maximum duration of three or four months, a reduction from previous allowances of up to 12 months for the initial term and 36 months total with renewals. While they act as a bridge for immediate coverage needs, these plans are not a substitute for comprehensive health insurance.

What Does Short-Term Health Insurance Cover?

Short-term health insurance policies are designed to cover unexpected medical events and typically include:

- Emergency care: Treatment for sudden, serious health issues like accidents or acute illnesses.

- Doctor visits: Appointments for non-preventive care, such as treating an illness or injury.

- Hospital stays: Coverage for inpatient services, often with limits on length of stay or certain treatments.

- Surgical procedures: Some plans cover medically necessary surgeries, though exclusions may apply.

Certain plans may also include limited coverage for generic prescription medications, but it’s uncommon for short-term insurance to cover prescriptions comprehensively.

These policies generally do not cover:

- Preventive services: Checkups, vaccinations, and routine screenings.

- Mental health care: Therapy, counseling, or psychiatric treatment.

- Substance abuse treatment: Inpatient or outpatient programs for addiction.

- Maternity care: Prenatal, childbirth, and postpartum services.

- Pre-existing conditions: Conditions diagnosed or treated before coverage begins.

- Chronic conditions: Common conditions such as diabetes, high blood pressure, high cholesterol, and others are typically excluded from coverage.

Coverage varies by provider, and optional add-ons like dental or vision insurance may be available. Always review a policy’s benefits and exclusions to ensure it meets your needs.

How Much Does Short-Term Health Insurance Cost?

Short-term health insurance offers a more affordable option compared to many traditional plans, but costs can vary depending on factors such as age, location, and the insurer. Key cost considerations include:

- Premiums: Starting at under $100 per month, these plans are accessible for many individuals.

- Out-of-pocket expenses: Higher deductibles and copayments can result in greater financial responsibility during claims.

- Coverage caps: Some plans limit the total amount they will pay for covered services.

In contrast, ACA plans often provide better financial protections, especially for those eligible for subsidies. According to the Centers for Medicare & Medicaid Services (CMS), 80% of ACA enrollees in 2024 can secure plans for $10 per month or less after subsidies. While short-term plans may seem cost-effective, they do not qualify for subsidies, which is a critical drawback for those on a limited budget.

Opting for short-term insurance can make sense for healthy individuals needing temporary coverage, but weigh these savings against the potential for higher costs in emergencies or uncovered care.

Benefits of Short-Term Health Insurance

Short-term health insurance offers several advantages, particularly for those in transitional situations or seeking affordable coverage. Key benefits include:

- Cost-effective Coverage: Affordable for healthy individuals with minimal healthcare needs or infrequent doctor visits.

- Quick Access: Simplified application process with immediate approval in many cases and coverage often starting as soon as the next day.

- Flexible Terms: Coverage durations can range from one month to the maximum allowed under federal or state laws. Plans can be canceled if no longer needed, offering flexibility not found with ACA plans.

- Temporary Solution: Provides a safety net during transitions like unemployment, waiting for employer-sponsored insurance, or moving between states.

These features make short-term health insurance a practical option for those who prioritize flexibility and cost savings over comprehensive benefits.

Limitations of Short-Term Health Insurance

Despite its advantages, short-term health insurance has notable limitations that should be carefully considered. These include:

- Limited Benefits: Excludes many essential health benefits such as preventive care, maternity care, mental health services, and substance abuse treatment. Prescription drug coverage, if included, is often limited to generic medications.

- Pre-Existing Condition Exclusions: These plans often deny coverage for ongoing medical issues, meaning you may face significant out-of-pocket expenses.

- No Consumer Protections: Not subject to ACA rules, so there’s no guarantee of coverage renewal or standardized benefits. Additionally, insurers can deny applications based on your health history.

- Temporary Coverage: Coverage ends after the specified term, leaving you to reapply or find alternative insurance. If you develop health issues during the term, you may struggle to secure future coverage.

These limitations underscore the importance of understanding what short-term health insurance does—and does not—cover before enrolling.

State Regulations for Short-Term Health Insurance

State-specific regulations play a significant role in the availability and structure of short-term health insurance. While federal guidelines set a baseline, many states impose stricter rules or prohibit these plans altogether.

As of 2024, the following states have banned short-term health insurance:

- California

- Colorado

- New Mexico

- Washington

- Minnesota

- Connecticut

- Hawaii

- Maine

- Massachusetts

- New York

- New Jersey

- New Hampshire

- Rhode Island

- Vermont

- Washington, DC

For example, Illinois passed legislation banning short-term health plans starting in January 2025, a move reflecting the trend toward prioritizing comprehensive coverage. In other states, insurers may voluntarily withdraw these plans due to complex regulatory requirements.

Before choosing short-term health insurance, verify its availability and compliance with your state’s rules.

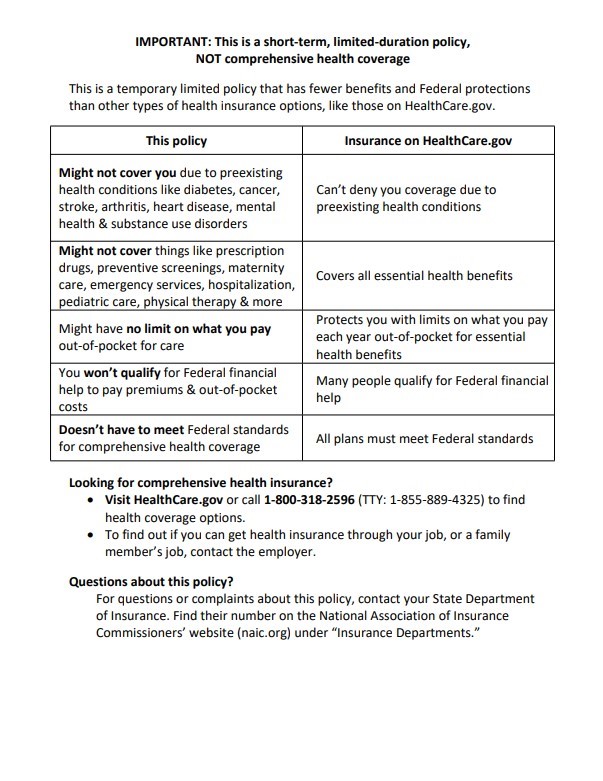

Short-Term Health Insurance vs. ACA Plans

Selecting the right health insurance plan can be challenging, especially with options like ACA and short-term health insurance. Each plan serves a unique purpose, but they differ significantly in coverage, cost, and flexibility.

| Feature | ACA Plans | Short-Term Health Insurance |

| Average Coverage | Covers all essential health benefits, including preventive care, maternity, and mental health. | Limited temporary coverage, excludes essential benefits like maternity, prescription drugs, preventive care, etc. |

| Costs | Premiums can range without subsidies but are generally affordable with financial help. | Premiums can be affordable but offer less coverage and more financial risk. |

| Pre-Existing Condition Coverage | Guaranteed coverage for pre-existing conditions. | Does not cover pre-existing conditions or limits coverage for them. |

| Enrollment Periods | Enrollment is limited to Open Enrollment or Special Enrollment periods. | Available year-round, no restrictions on when you can apply. |

| Plan Duration | Coverage is annual, renewable each year with no gaps. | Coverage is temporary, typically only one to four months, and non-renewable in many cases. |

Who Should Consider Short-Term Health Insurance?

Short-term health insurance is ideal for specific situations, particularly those involving temporary gaps in coverage that cannot otherwise be filled with ACA plans. This includes:

- Recently unemployed individuals: Those without COBRA or ACA subsidies.

- Graduates: Transitioning from school to full-time employment.

- Retirees under 65: Awaiting Medicare eligibility.

- Travelers: Seeking temporary domestic coverage during short trips.

However, these plans may not be suitable for:

- Individuals with chronic health issues: Ongoing medical needs can result in high out-of-pocket costs.

- Those requiring comprehensive services: Maternity, mental health, and preventive care are not covered.

- Anyone needing consistent coverage: Long-term insurance needs are better met with ACA plans.

Alternatives to Short-Term Health Insurance

- ACA Marketplace Plans: Comprehensive coverage with subsidies for eligible individuals. Best for those seeking long-term, affordable insurance.

- COBRA Coverage: Continuation of employer-based insurance, often at a higher cost but with the same benefits. Ideal for those needing continuity of care.

- Medicaid and CHIP: State-run programs providing free or low-cost insurance for eligible low-income individuals and families. Available year-round.

- Direct Primary Care: Membership-based model offering unlimited primary care visits for a flat fee. Suitable for those who need regular checkups but not emergency or specialist care.

Bringing It All Together

Short-term health insurance is an affordable, flexible option for those needing immediate, temporary coverage. However, it comes with significant limitations, including exclusions for pre-existing conditions and essential health benefits.

Before enrolling, consider your healthcare needs, state regulations, and available alternatives like ACA plans or Medicaid. By understanding the trade-offs, you can choose a plan that best supports your situation and ensures peace of mind during coverage gaps.

Disclaimer: This article is for informational purposes only. Consult with a tax, legal, or insurance advisor to determine the best plan for your specific needs.

The following notice applies to short-term plans.