Small Business

What is a Consumer-Driven Health Plan for Small Business?

Updated on June 14, 2022

Share

As an employer looking to save on small business health insurance costs, you may be wondering what some of your additional options are. A consumer-driven health plan (CDHP) may be an effective way to help provide affordable health insurance coverage for your employees.

What is a consumer-driven health plan (CDHP) for small business?

A consumer-driven health plan (CDHP) is a high-deductible health plan which allows you to pay for part of the cost of out-of-pocket medical services using pre-tax dollars in a specified savings account.

Examples of the pre-tax savings accounts associated with a consumer-driven health plan include:

- Health Savings Accounts – A Health Savings Account (HSA) allows workers to pay for health care expenses using a tax-advantaged, employee-owned savings account in conjunction with a qualifying high-deductible health plan (HDHP). HSA funds roll over each year.

- Flexible Spending Accounts – A Flexible Spending Account (FSA) is an employer-owned tax-advantaged account that provides employees with a set amount of funds to use during the year, and can be paired with any type of health insurance plan, not just a HDHP.

- Health Reimbursement Arrangements – A Health Reimbursement Arrangement (HRA) is a tax-free monthly allowance that lets workers pay for their health care expenses; the employer then reimburses employees from the allowance after they submit proof of their medical costs.

While one of the major differences between these accounts is the degree to which they are funded by the employer and employee, the reason why the consumer-driven health plan gets its name is due to its focus on encouraging consumers to take a more active, self-aware role in choosing their health care.

Thus, the goal of a CDHP is to have consumers shop around for affordable coverage to be better able to determine what kind of medical care is necessary or unnecessary, depending on their needs.

Why would a small business consider a CDHP for its employee group health coverage?

Although being enrolled in a high-deductible health plan means greater deductible costs and out-of-pocket maximum expenses, the main advantage of a CDHP is having lower monthly premiums, as well as potential tax savings through reducing taxable income.

As a result of lower employee premiums available through CDHP coverage, small business employers end up having to pay less in terms of their required cost-sharing contributions, which could mean considerable savings.

A consumer-driven health plan may be an effective choice for younger or relatively healthy employees who have less of a need for recurring medical services. Conversely, a CDHP may be less desirable for small business employees with a greater need for more frequent or regular medical care, due to the risks of a higher deductible and more out-of-pocket costs.

In terms of CDHP tax advantages, an HSA provides employees with several opportunities for tax savings:

- HSA contributions are tax-deductible.

- HSA funds used to pay for qualified medical expenses can be withdrawn on a tax-free basis.

- HSA account funds generally grow tax-free each year.

Note that a consumer-driven health plan does not replace a traditional insurance plan; rather, a CDHP is meant to be used as a health plan combined with a pretax account in order to better manage personal health care costs.

How many small businesses have consumer-driven health plan coverage?

Consumer-driven health plans may be offered by more small business employers than you may think. A high-deductible health plan with a savings option (HDHP/SO) was offered by 22 percent of firms with 3 to 24 workers, and 45 percent of firms with 25 to 199 workers, according to the Kaiser Family Foundation 2019 Employer Health Benefits Survey.

Can a consumer-driven health plan help employees save money?

Since all employees have different health care needs, a CDHP may or may not be an effective health insurance coverage option in terms of cost savings. However, for employees who rarely need to use medical services, a CDHP may be an affordable choice to consider.

According to a report from the Health Care Cost Institute (HCCI):

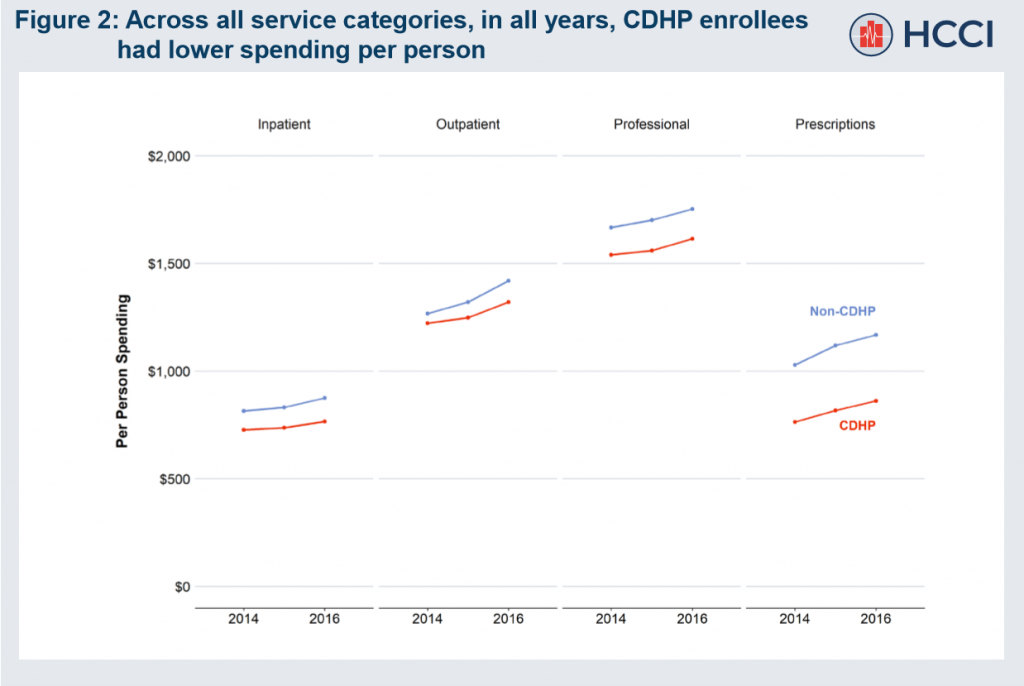

- Individuals enrolled in a CDHP in 2016 had 13 percent lower total spending, on average, than individuals not enrolled in CDHP coverage.

- Across four service categories (inpatient, outpatient, professional, and prescriptions), spending per person for CDHP enrollees was consistently lower than for non-CDHP enrollees.

- In each service category, lower per-person spending for the CDHP population largely reflected lower average levels of service use.

Source: Health Care Cost Institute (HCCI)

Overall, the utility of a CDHP will vary depending on the health care needs, budget, and cost preferences of small business owners and their employees.

To find out more about your choices for small business health insurance coverage, visit eHealth.com today to get instant group health quotes and compare different small business health insurance plans. You can also speak with one of our licensed health insurance agents for personalized, unbiased advice on how to select the right health plan for your business.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.