Affordable Health Insurance: Finding coverage that fits your budget

Looking for low-cost health insurance? Discover plans at the right price for your budget.

Why affordable health insurance matters

Affordable health insurance is not just a matter of financial convenience; it’s a fundamental aspect of maintaining your well-being and that of your family. It plays a crucial role in ensuring that you have access to the medical care and services you need without straining your budget. In this article, we’ll delve into why affordable health insurance is essential, the benefits it offers, and how it can positively impact your life. Whether you’re searching for individual or family coverage, understanding the significance of affordable health insurance is the first step towards safeguarding your health and financial stability.

eHealth Insurance is the nation’s leading online source of health insurance. eHealth Insurance offers thousands of health plans underwritten by more than 180 of the nation’s health insurance companies, including Aetna and Blue Cross Blue Shield. Compare plans side by side, get health insurance quotes, apply online and find affordable health insurance today.

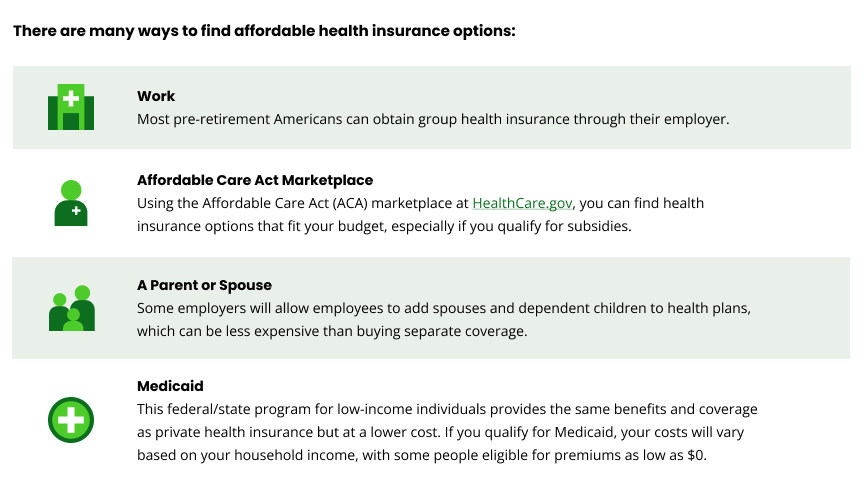

Ways to get affordable health insurance plans

The costs of health insurance

According to the Kaiser Family Foundation (KFF) there are 21,446,150 individuals in 2024 who selected a Marketplace plan. Health insurance costs can vary widely based on several factors, including age, the metal tier of the plan, and geographic location. Below, we provide an overview of average health insurance costs to help you understand what you might expect to pay.

2024 Government Monthly Contribution and Weighted Average Premiums

| Coverage Type | Government Contribution | Weighted Average Premium |

| Self Only | $588.10 | $816.81 |

| Self Plus One | $1,270.75 | $1,764.95 |

| Self and Family | $1,400.06 | $1,944.52 |

Average Health Insurance Costs by Metal Tier in the United States

Health insurance plans available on the ACA marketplace are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent the balance between monthly premiums and deductibles in 2024. For the 2024 plan year: The out-of-pocket limit for a Marketplace plan can’t be more than $9,450 for an individual and $18,900 for a family.

| Cost Type | Average Cost Bronze | Average Cost Silver | Average Cost Gold | Average Benchmark |

| Premiums in 2024 | $364 | $468 | $488 | $477 |

| Deductibles in 2024 | $7,258 | $5,241 | $1,430 | $3,057 |

Additional Factors Affecting Health Insurance Costs

- Geographic Location: Insurance premiums can vary significantly depending on the state and even the specific region within a state. Areas with higher healthcare costs will generally have higher premiums.

- Subsidies and Tax Credits: If you qualify for subsidies based on your income, your monthly premiums could be significantly reduced. The ACA marketplace at HealthCare.gov offers tools to check your eligibility for these subsidies.

- Plan Type: The type of plan you choose (HMO, PPO, EPO, or POS) can affect your premiums. Generally, plans with more flexibility in choosing providers (like PPOs) tend to have higher premiums.

- Household Income: Your household income relative to the federal poverty level (FPL) can affect the amount you pay. For example, those with incomes below 250% of the FPL may qualify for cost-sharing reductions.

Understanding these factors and reviewing the tables can help you make an informed decision about the health insurance plan that best fits your needs and budget.

What to consider when searching for cheap health insurance

Don’t know where to start with health insurance? Enter your zip code above to explore your options.

Navigating the complex world of health insurance can be challenging. eHealth is here to help you find and compare health insurance plans during your Open Enrollment Period tailored to your needs, all while keeping your budget in mind. Our experienced agents are ready to provide personalized guidance and answer your questions. Call us at 1-866-799-0045, TTY users dial 711, from Monday to Friday between 8 am – 10 pm, and on weekends from 10 am – 7 pm ET.

When looking for and comparing health insurance plans, consider the following factors:

- Coverage Needs: Assess your healthcare requirements, including prescription drugs, doctor visits, and specific treatments. Different plans may offer varying coverage levels for these services.

- Budget Constraints: Determine your budget for health insurance premiums and out-of-pocket expenses. Balancing affordability with comprehensive coverage is essential.

- Provider Networks: Ensure that your preferred doctors, specialists, and hospitals are in-network. This can help you save on healthcare costs.

- Benefits and Features: Explore additional benefits, such as dental, vision, and wellness programs, that may be included in the plan.

- Deductibles and Copayments: Understand the cost-sharing structure of the plan, including deductibles, copayments, and coinsurance. This directly affects your out-of-pocket expenses.

- Annual Out-of-Pocket Maximum: Check the plan’s maximum limit on what you’ll need to pay in a given year. Once you reach this limit, the plan typically covers your medical expenses in full.

- Prescription Drug Coverage: If you require specific medications, verify that the plan includes them in its formulary.

- Quality Ratings: Consider the plan’s quality ratings and reviews to assess its track record of customer satisfaction and healthcare outcomes.

By taking these factors into account and with eHealth’s expert assistance, you can find and compare the best health insurance plans, including Affordable Care Act Plans that align with your unique needs and budget.

Find inexpensive health insurance in your state

Finding affordable health insurance can be challenging, but there are options available that fit various budgets and needs. By exploring state-specific health insurance marketplaces and programs, you can discover plans that offer essential coverage at a lower cost. Below, we provide links to resources for each state, helping you navigate your options and find the best health insurance plans for your situation.

- Alabama Health Insurance

- Alaska Health Insurance

- Arizona Health Insurance

- Arkansas Health Insurance

- California Health Insurance

- Colorado Health Insurance

- Connecticut Health Insurance

- Delaware Health Insurance

- Nebraska Health Insurance

- Nevada Health Insurance

- New Hampshire Health Insurance

- New Jersey Health Insurance

- New Mexico Health Insurance

- New York Health Insurance

- North Carolina Health Insurance

- North Dakota Health Insurance

- Ohio Health Insurance

- Florida Health Insurance

- Georgia Health Insurance

- Hawaii Health Insurance

- Idaho Health Insurance

- Illinois Health Insurance

- Indiana Health Insurance

- Iowa Health Insurance

- Kansas Health Insurance

- Kentucky Health Insurance

- Oklahoma Health Insurance

- Oregon Health Insurance

- Pennsylvania Health Insurance

- Rhode Island Health Insurance

- South Carolina Health Insurance

- South Dakota Health Insurance

- Tennessee Health Insurance

- Texas Health Insurance

- Utah Health Insurance

- Louisiana Health Insurance

- Maine Health Insurance

- Maryland Health Insurance

- Massachusetts Health Insurance

- Michigan Health Insurance

- Minnesota Health Insurance

- Mississippi Health Insurance

- Missouri Health Insurance

- Montana Health Insurance

- Vermont Health Insurance

- Virginia Health Insurance

- Washington DC Health Insurance

- Washington Health Insurance

- West Virginia Health Insurance

- Wisconsin Health Insurance

- Wyoming Health Insurance

Frequently Asked Questions

What is the best affordable health insurance?

If you are looking for the best affordable health insurance, understand that it comes in different shapes and forms. For example, if you are someone who is relatively healthy, then you might be looking for a plan that has a high deductible and a low premium. That means that you don’t have to spend as much money on health insurance each month, but it is unlikely that you will have to pay the deductible because you are relatively healthy.

On the other hand, if you are someone who has a lot of chronic medical conditions, then you might be looking for a plan that provides you with better coverage. For example, you might need a health insurance plan that provides coverage for mental health benefits. Or, you might be looking for a plan that provides you with more benefits regarding prescription drug coverage. Even though it might cost you more money to purchase this type of health insurance, you could save money in the long run because the plan provides even more benefits.

Can you negotiate the cost of health insurance?

It is very difficult to negotiate the cost of health insurance with a health insurance company. If you want to negotiate the price of health insurance with a health insurance company, they will probably just offer you different plans. Then, you can take a look at the different plans available to figure out which one is best for your needs.

On the other hand, if you get health insurance through your employer, you may be able to negotiate the cost of health insurance with your employer. You might be able to convince your employer to provide you with better health insurance benefits or a greater subsidy. That way, you don’t necessarily have to spend as much money on health insurance out-of-pocket. Every employer is different, so you need to talk about this with your employer directly.

Do I need health insurance?

Although there hasn’t been a federal mandate for health insurance coverage since 2019, there are some states that require you to have health insurance or risk being fined. See more on whether or not health insurance is required in your state to make sure you have the coverage you need.

That being said, having health insurance is simply a good idea. Medical bills can be very expensive, and health insurance is a way to protect yourself against potentially catastrophic medical expenses. For example, if you have to spend multiple days in the ICU, or if you require emergency surgery, then it’s wise to have health insurance to help you cover the expenses.

Remember, the right health insurance policy for one person is not necessarily going to be the right health insurance policy for you. Take a look at the benefits and drawbacks of each health insurance policy before you make a decision.

Can I buy affordable health insurance at any time?

Keep in mind the following dates to ensure you can get the coverage you need.

- November 1: Open Enrollment begins — this is the first day you can enroll in, renew, or change health plans through the Marketplace. Coverage can start as soon as January 1.

- December 15: Last day to enroll in or change plans for coverage to start on January 1.

- January 1: Coverage starts for those who enrolled or changed plans by December 15 and paid their first premium.

- January 15: Open Enrollment ends — this is the last day to enroll in or change Marketplace health plans for the year. After this date, you can enroll in or change plans only if you qualify for a Special Enrollment Period.

- February 1: Coverage starts for those who enrolled or changed plans between December 16 and January 15 and paid their first premium.

From January 16 to October 31, you can still get coverage if you qualify for a Special Enrollment Period due to a life event or based on your income. You can apply for free or low-cost coverage through Medicaid or the Children’s Health Insurance Program (CHIP) at any time.

You can get health coverage now if you qualify for:

- A Special Enrollment Period due to a life event or based on your income.

- Free or low-cost coverage through Medicaid or the Children’s Health Insurance Program (CHIP).

Check if you qualify.

IMPORTANT: This is a short-term, limited-duration policy, NOT comprehensive health coverage

This is a temporary limited policy that has fewer benefits and Federal protections than other types of health insurance options, like those on HealthCare.gov.

| This policy | Insurance on HealthCare.gov |

|---|---|

| Might not cover you due to preexisting health conditions like diabetes, cancer, stroke, arthritis, heart disease, mental health & substance use disorders | Can't deny you coverage due to preexisting health conditions |

| Might not cover things like prescription drugs, preventive screenings, maternity care, emergency services, hospitalization, pediatric care, physical therapy & more | Covers all essential health benefits |

| Might have no limit on what you pay out-of-pocket for care | Protects you with limits on what you pay each year out-of-pocket for essential health benefits |

| You won't qualify for Federal financial help to pay premiums & out-of-pocket costs | Many people qualify for Federal financial help |

| Doesn't have to meet Federal standards for comprehensive health coverage | All plans must meed Federal standards |

Looking for comprehensive health insurance?

- Visit HealthCare.gov or call 1-800-318-2596 (TTY: 1-855-889-4325) to find health coverage options.

- To find out if you can get health insurance through your job, or a family member's job, contact the employer.

Questions about this policy?

For questions or complaints about this policy, contact your State Department of Insurance. Find their number on the National Association of Insurance Commissioners' website (naic.org) under "Insurance Departments."